The BIS report indicates that 71% of central banks have embraced generative AI to boost cybersecurity, with more planning to follow the same step.

The Bank for International Settlements (BIS) is optimistic regarding the potential for generative artificial intelligence (AI). This area has garnered significant attention from numerous central banks aiming to achieve widespread implementation.

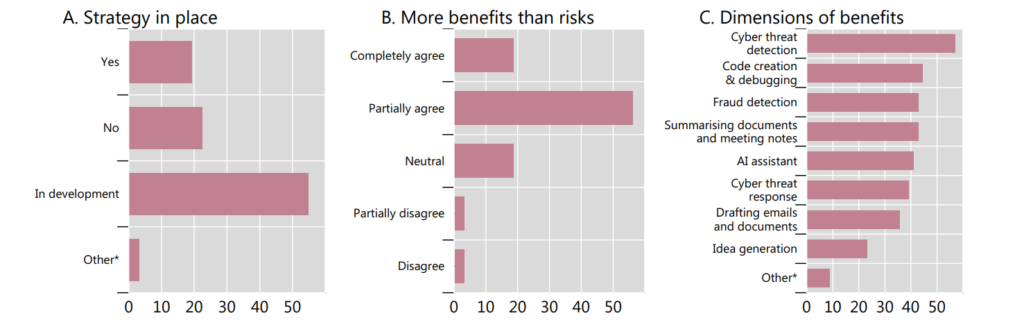

A survey was conducted by the BIS, an international financial institution composed of monetary authorities and 63 central banks, to determine the level of interest among 32 central bank members in implementing generative AI tools for cybersecurity purposes. The report discovered:

“Within the next one to two years, 26% of respondents intend to integrate such tools into their operations, while 71% are already utilizing gen AI.”

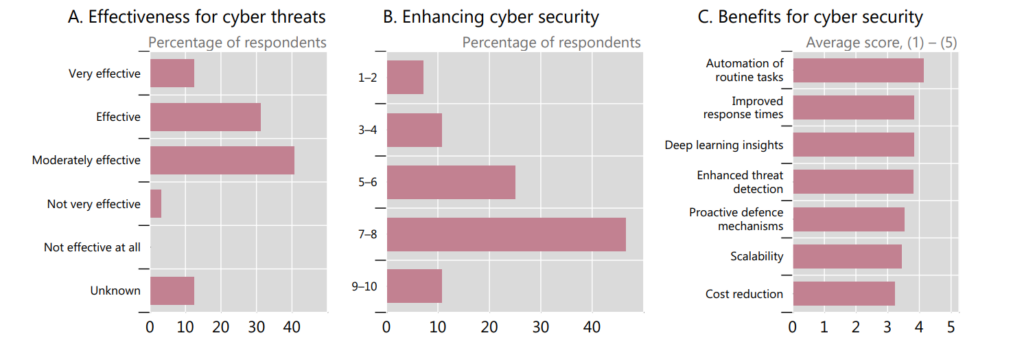

According to the BIS, all its members will implement generative AI to bolster their internal cybersecurity measures. Compared to conventional tools, central banks that have already implemented generative AI have lauded its efficacy in detecting cyber threats.

Moreover, banks’ response times to intrusions have been accelerated, and suspicious trends and anomalies have been detected with the assistance of generative AI tools. Nevertheless, central banks continue to be preoccupied with the expenses linked to deploying generative AI tools.

Furthermore, the BIS report emphasized:

“Risks related to social engineering and zero-day attacks as well as unauthorized data disclosure are of highest concern.”

There is near-unanimity among central banks regarding the potential for generative AI tools to supplant cybersecurity personnel in executing mundane duties. This action is expected to “free up resources” that BIS can repurpose for alternative initiatives.

The BIS comprises the central banks of many leading economies, including India, Australia, China, France, Belgium, Japan, South Korea, Italy, Switzerland, and the United Kingdom.

Consult the overview by Cointelegraph for more information on generative AI.

Recently, the BIS and seven central banks allied to investigate asset tokenization in the monetary system in conjunction with private financial institutions.

The participating nations are the Federal Reserve Banks of France, Japan, South Korea, Mexico, Switzerland, the United Kingdom, and the United States.

The initiative, which BIS has dubbed “Project Agora,” will be founded on a unified ledger concept connecting tokenized wholesale central bank money and commercial bank deposits.