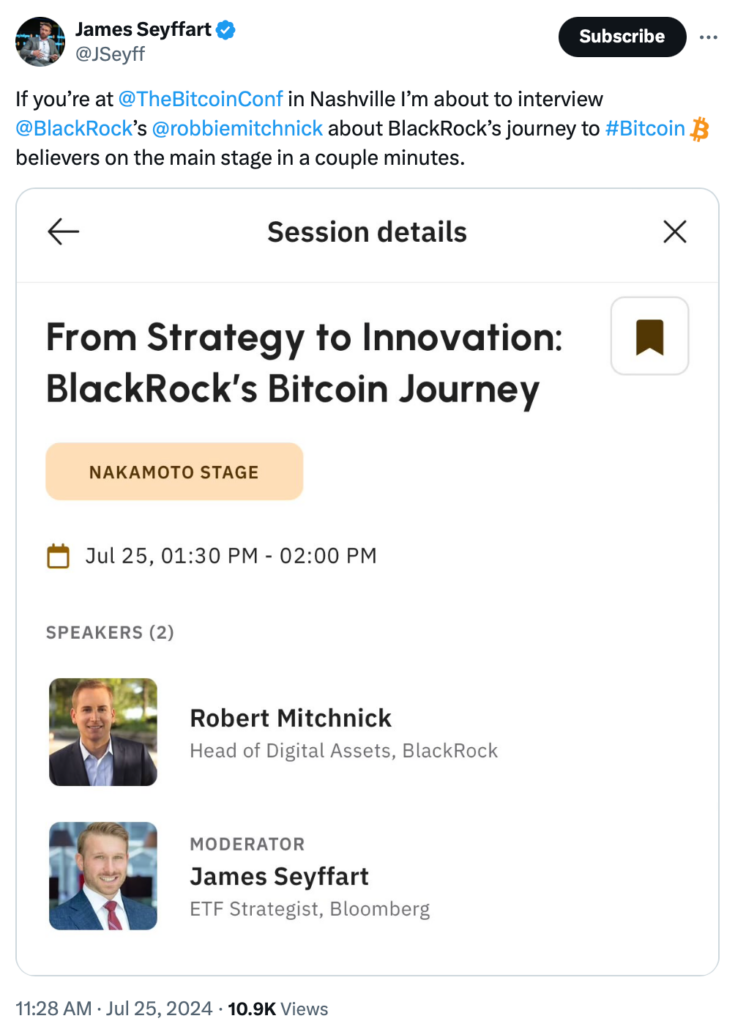

The director of digital assets at BlackRock, Robert Mitchnick, talked with Bloomberg’s James Seyffart regarding exchange-traded funds (ETFs) at Bitcoin 2024.

Client demand was the driving force behind the creation of the Bitcoin exchange-traded fund (ETF), and the funds are just beginning to gather momentum, BlackRock head of digital assets Robert Mitchnick said at the Bitcoin2024 event. He was interrogated on stage by Bloomberg journalist James Seyffart.

BlackRock CEO Larry Fink was a vocal skeptic of cryptocurrency when Mitchnick was appointed in 2018. Fink was subsequently “orange-pilled,” pivoting to label Bitcoin “digital gold” in a recent interview.

Digital assets require investigation.

Mitchnick attributed Fink himself for the change of heart. “Larry deserves a lot of credit for the time he spent studying the space,” Mitchnick said. He added:

“If you are a student of financial history and geopolitics or you are a technologist, Bitcoin tends to come more easily, and Larry is very much both those things.”

Larger forces came into play as well. Mitchnick noted that, with or without regulatory clarity, crypto as an asset class and technology was obviously “here to stay.” They had institutional-grade infrastructure, and “the final piece that helped push us over the top” was client demand.

The client base of crypto exchange-traded funds (ETFs) is currently in the process of being

Seyffart stated that Bitcoin ETFs were the most successful and prominent ETF launches in history. He estimated that the iShares Bitcoin Trust (IBIT) contributed 20-25% of BlackRock’s revenue this year, making it the asset manager’s second most successful offering after the S&P500 ETF.

Mitchnick stated that direct investors were the primary source of demand at the time of the ETF’s introduction. Institutional investors and BlackRock wealth advisory continue to accumulate momentum. “Those are significantly longer journeys, and we are only halfway through that path,” he noted.

No significant wealth advisory platforms, including Morgan Stanley, UBS, and Merrill Lynch, have initiated the solicitation of Bitcoin ETFs. This implies that the ETFs will only be available upon client request.

Mitchnick stated that “many of the largest platforms are accelerating their efforts to do so,” even though it typically takes multiple years for a new ETF to achieve that solicited status.

He believed that the situation might begin to shift this year. He estimated that the BlackRock Registered Independent Advisers who have adopted the ETFs are allocating 2-3% of their funds to them.

Mitchnick stated that institutions proceed at least as cautiously as they do when conducting research and due diligence on new assets.