According to analysts, the all-stock transaction will result in the Canadian crypto platform becoming “a smaller version of Galaxy Digital.”

In an all-stock transaction that analysts predict will convert the Canadian crypto platform into “a smaller version of Galaxy Digital,” DeFi Technologies (CBOE CA: DEFI) agreed to acquire trading desk Stillman Digital on July 9.

“The buyout is a strategic move that not only diversifies our client base and revenue streams but also expands our capabilities in the trading sector,” said Olivier Roussy Newton, CEO of DeFi Technologies, as of the close of trading on July 8.

Stillman was valued at approximately CA$4.22 million ($3.1 million). The statement indicates that the agreement has been reached but not finalized.

Mark Palmer, an equity research analyst at The Benchmark Company, informed Cointelegraph in an email that the resulting DeFi platform, which would integrate crypto asset management, execution trading, and proprietary trading, would be comparable to a scaled-down version of Galaxy Digital.

This is because the platform would incorporate variations on Galaxy’s product offerings.

Palmer stated that the forthcoming acquisition indicates the necessity for crypto platforms to achieve scale to exploit size and diversification to more effectively navigate the industry’s substantial momentum fluctuations and the growing competition in numerous sub-verticals.

Valor Solana, one of the most extensive Solana exchange-traded products (ETPs) in the European Union, is operated by DeFi Technologies’ investment management subsidiary, Valor. Valor Solana is traded alongside a variety of other altcoin ETPs.

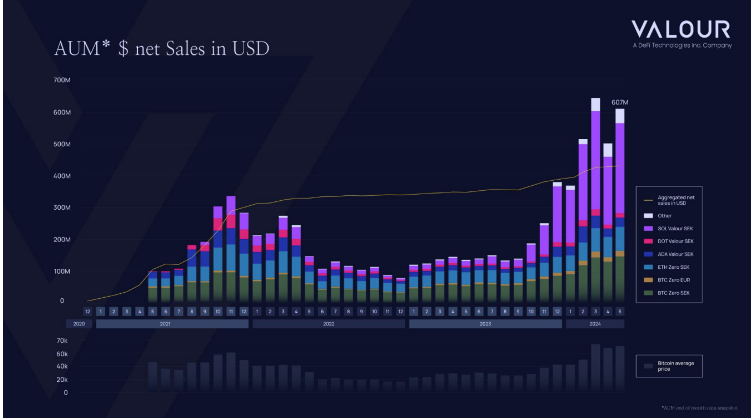

DeFi Technologies’ vice president of marketing and communications, Curtis Schlaufman, has stated that the investment platform, which oversees approximately $600 million in assets, is one of a few asset managers permitted to integrate staking into its publicly listed funds.

Valor’s staking investment products are Bitcoin, Ether, and Internet Computer (ICP). Schlaufman stated that DeFi Technologies also administers numerous other altcoin ETPs and introduced a new business line earlier this year that concentrates on market-neutral crypto trading strategies.

Due to Stillman’s lucrative crypto onramping business line, the acquisition of Stillman will “enhance [DeFi Technologies’] trading capabilities while also producing upside during bear markets,” according to Schlaufman.

Stillman has facilitated over $15 billion in trading volume since its inception, with approximately $4 billion of that volume occurring in the first quarter of 2024, according to the statement.

M&A advisory Architect Partners has reported a significant increase in mergers and acquisitions (M&A) in the crypto space in 2024. This trend is primarily due to consolidating brokerages, exchanges, and other financial infrastructure providers.