The possibility for Ethereum ETFs to launch next month depends on how quickly approved applicants amend their S-1 registration statements and feedback from SEC.

The potential launch date for the recently authorized spot Ether (ETH) exchange-traded funds is mid-June, contingent upon the United States securities regulator adhering to a timetable comparable to its spot Bitcoin ETF process.

Today, 19b-4 filings for Spot Ether ETFs were approved, granting the funds listing on their respective exchanges. To commence trading, applicants must initially possess S-1 registration statements that have been approved.

James Seyffart, an analyst at Bloomberg ETFs, has speculated that S-1 approvals may occur within “a few weeks” but added that the process typically lasts up to five months, so “certainly” more time could elapse.

An additional Bloomberg ETF analyst, Eric Balchunas, stated, “Mid-June is most certainly feasible.”

Balchunas anticipates that the S-1 amendments will be subject to a single round of comments, analogous to how the SEC responded to spot Bitcoin ETF applicants.

He estimated that the process would take approximately two weeks; this is how he arrived in mid-June.

[However, this is only a conjecture. “We shall see,” emphasized Balchunas.

VanEck promptly submitted its amended S-1 after the approval of its 19b-4, and it is anticipated that additional applicants will do so shortly.

Gabriel Shapiro, general counsel for Delphi Labs, noted that the SEC’s approval was “delegated authority” granted by its Division of Trading and Markets and that one of the five SEC Commissioners may dispute the decision within the next ten days.

Theoretically, such a challenge is conceivable, according to digital asset attorney Joe Carlasare, who told Cointelegraph, “but it won’t.”

“They wouldn’t have passed it through trading and markets without knowing that no Commissioner opposed it.”

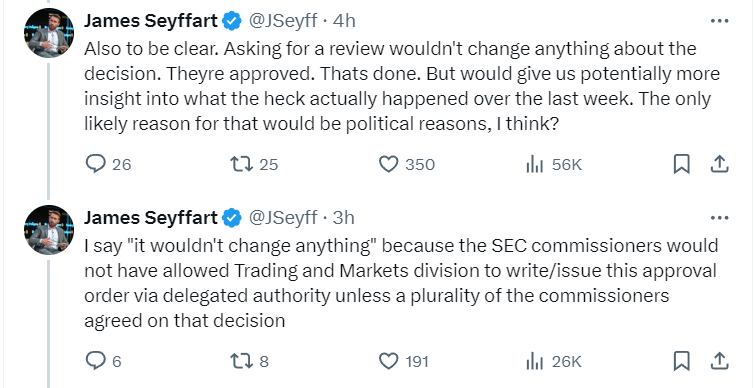

Seyffart presents a contrasting viewpoint, asserting that delegated authority is customary in decision-making and that mandating an official vote for each document and decision would be “irrational.” He further stated that requesting a review “likely would not result in any modifications” to the approvals.

Seyffart anticipates that spot Ether ETFs will experience 20% of the flows observed in spot Bitcoin ETFs should the S-1s be approved. In contrast, Balchunas provides a more conservative estimate ranging from 10% to 15%.

Spot Bitcoin ETFs have generated a net inflow of $13.3 billion, as reported by Farside Investors, since their introduction approximately four and a half months ago.

Despite capturing 20% of that, spot Ether ETFs would have amassed a total of $2.66 billion during the same period.

There are concerns that significant outflows from the converted Grayscale Ethereum Trust into spot ETF form could occur in the spot Ether ETF market. These outflows could be comparable to those observed with the firm’s converted Bitcoin investment product.

Arkham Intelligence data indicates that the Grayscale Ethereum Trust currently holds more than $11.3 billion.

Eight petitioners, including VanEck, BlackRock, Fidelity, Grayscale, Franklin Templeton, ARK 21Shares, Bitwise, and Invesco Galaxy, were granted regulatory approval on May 23.

On that particular day, Hashdex was the sole issuer of ETFs that failed to obtain regulatory approval.