Despite the potential spot ETF and recent macroeconomic data, Ether derivatives were unable to sustain elevated optimism levels

Ether ETH ($3,514) traders were taken aback when its price approached the $3,500 mark on June 11, liquidating $90 million in ETH leveraged longs within 48 hours. Even though the decline was primarily influenced by macroeconomic developments, such as a revised prognosis by the U.S. central bank and data on U.S. jobless claims, Ether investors have now shifted to a bearish stance, as supported by two specific metrics.

The weakness of the ETH price is partially explained by the Federal Reserve’s projections

The U.S. Federal Reserve (Fed) disclosed its interest rate projections on June 12, indicating that four officials anticipate no adjustments until the end of 2024. The remaining 15 officials were divided, anticipating one or two reductions by the end of the year. This disappointed risk-on investors, diminishing the incentives to transition from fixed-income assets. However, Fed Chair Jerome Powell underscored that the labor market and price stability would continue to be critical factors in formulating monetary policy.

In the previous week, the number of Americans petitioning for new unemployment benefits had reached a 10-month high of 242,000, according to the U.S. Labor Department’s report on June 13. Oliver Allen, a senior U.S. economist at Pantheon Macroeconomics, stated in an interview with Yahoo Finance that “small businesses are beginning to feel the effects of high long-term rates, tight credit conditions, and a gradual softening in demand.”

In general, risk-on assets such as Ether are advantageous when macroeconomic indicators are weak, as they may induce the Federal Reserve to contemplate interest rate cuts sooner if economic weaknesses persist. Nevertheless, the absence of a U.S. spot Ether exchange-traded fund (ETF) only exacerbates the uncertainty, as there is no guarantee that investors will migrate to alternative assets such as cryptocurrencies in a difficult economic environment.

Gary Gensler, the U.S. Securities and Exchange Commission Chair, has declared that the S-1 filings for individual Ether ETFs may require up to three months to be approved, as reported by Fox Business journalist Eleanor Terrett. Investors are becoming more hesitant to acquire bullish ETH derivatives due to this delay and other factors, including a decrease in the activity of decentralized applications.

Ether derivatives indicate a decrease in demand for favorable positions

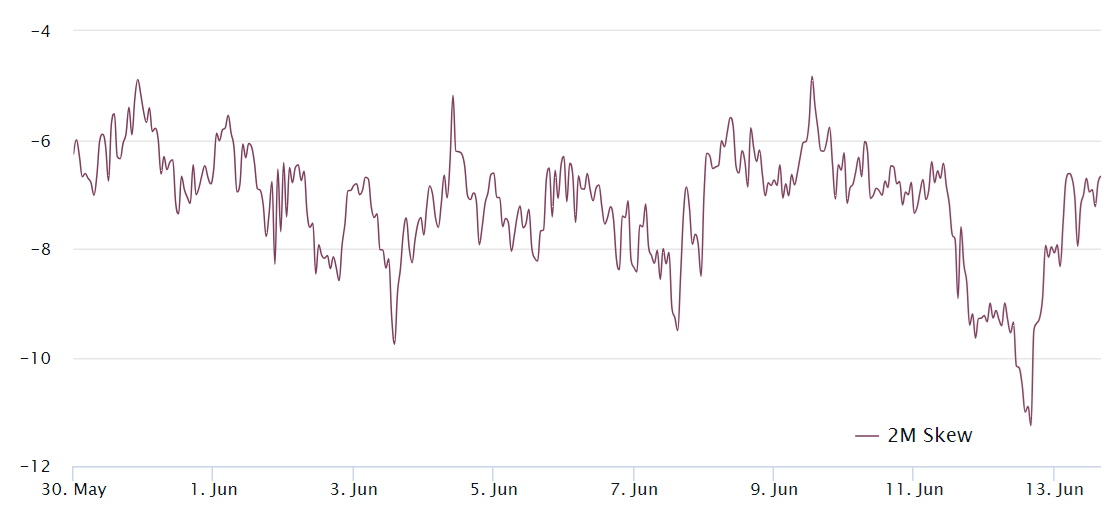

The delta skew quantifies the proportion of bullish and bearish options in demand. A positive skew suggests a preference for put options (sell), whereas a negative skew indicates a greater demand for call options (buy). Neutral markets typically exhibit a delta skew that ranges from -7% to +7%, indicating that the pricing of call and put options is balanced.

The Ether 25% delta skew fell below -7% between June 11 and June 12, entering the bullish territory. Nevertheless, this optimistic sentiment dissipated on June 13 when Ether could not maintain its momentum above the $3,600 level. Consequently, traders began assigning comparable probabilities to positive and negative ETH price fluctuations.

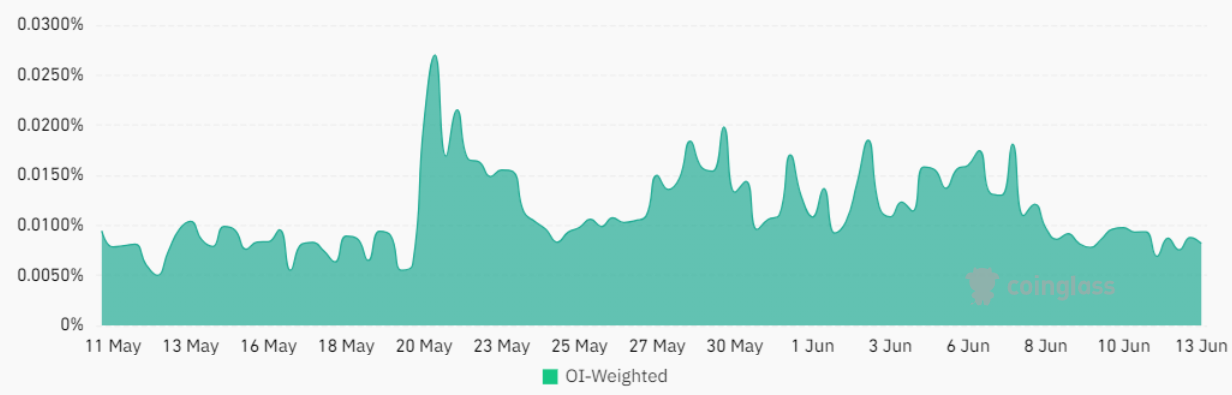

Retail traders frequently select perpetual futures, a derivative that closely monitors the price fluctuations of the underlying spot markets. Exchanges impose a fee every eight hours, which is referred to as the funding rate, to regulate balanced risk exposure. When purchasers (longs) demand additional leverage, this rate is positive; conversely, it is negative when sellers (shorts) require additional leverage.

Currently, the Ether perpetual funding rate has reached a plateau of 0.01% per 8-hour period, equating to 0.2% per week. Particularly during periods of increased activity, the weekly cost for leveraged long positions can reach as high as 1.2%, which is why this rate is generally considered neutral. Notably, the funding rate was 0.035% per week on June 6, which suggests that sentiment has declined over the past week.

Given that Ether derivatives could not sustain elevated optimism levels, despite the potential catalyst of an upcoming U.S. spot ETF and macroeconomic data indicating a weakening employment market, the probability of ETH surpassing $3,700 in the near term appears low.