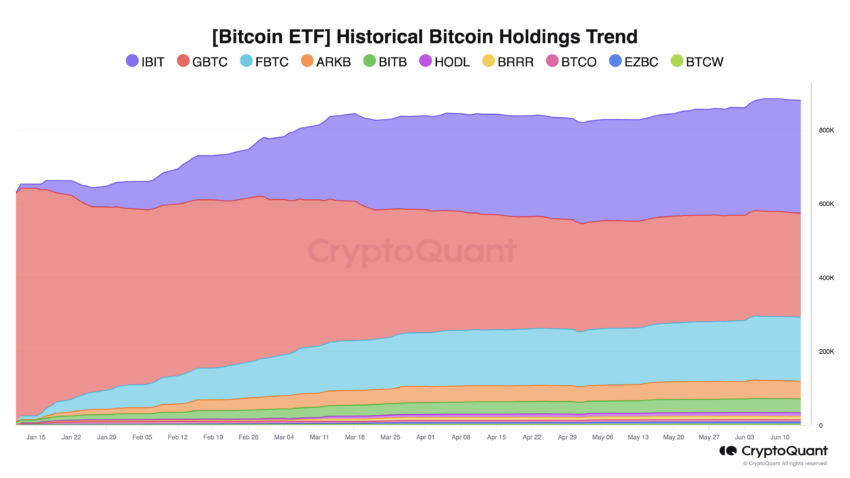

The introduction of Bitcoin exchange-traded funds (ETFs) in January was a significant milestone. Nevertheless, financial advisors are exercising caution regarding these novel investment vehicles

During the Coinbase State of Crypto Summit in New York City, Samara Cohen, BlackRock’s Chief Investment Officer of ETF and Index Investments, offered valuable insights.

The Reasons Financial Advisors Avoid Bitcoin ETFs

Cohen stated that self-directed investors are responsible for purchasing approximately 80% of Bitcoin ETFs through online brokerage accounts. Hedge funds and brokerages have also been active purchasers, as indicated by the 13-F filings from the previous quarter. Nevertheless, registered investment advisors continue to exhibit caution.

Cohen declared, “I would describe them as cautious…” That is their responsibility. She underscored the fiduciary responsibility that advisors have to their clients, pointing out that the historical price volatility of Bitcoin, which has reached 90% at times, requires a comprehensive risk analysis and due diligence.

Financial advisors meticulously assess data and risk analytics to ascertain the appropriate function of Bitcoin in investment portfolios, taking into account factors such as risk tolerance and liquidity requirements.

“This is a moment, in terms of really putting forward important data, risk analytics [and determining] the role Bitcoin can play in a portfolio, what sort of allocation is appropriate given an investor’s risk tolerance, their liquidity needs. That’s what an advisor is supposed to do, so I think this journey that we’re on is exactly the right one and they’re doing their jobs,” Cohen added.

Some analysts maintain a bullish perspective on the future of Bitcoin, even though financial advisors remain cautious.

Bernstein, a significant asset manager with $725 billion in assets, estimates that Bitcoin’s price could surpass $1 million by 2033. By 2025, the new forecast anticipates a cycle-high of $200,000. This prediction is influenced by the limited supply of Bitcoin and the unprecedented demand from spot ETFs.

Bernstein’s previous estimate for 2025 was $150,000, which indicates their increasing confidence in Bitcoin’s potential.

“Around $15 billion of net new flows have been brought in by the ETFs combined. We expect Bitcoin ETFs to be equivalent to approximately 7% of Bitcoin in circulation by 2025 and nearly 15% of Bitcoin supply by 2033,” Bernstein analysts wrote.

William Quigley, the co-founder of WAX, also addressed the proliferation of ETFs for other cryptocurrencies, such as Solana. “Wall Street is greedy,” Quigley stated, implying that the success of Bitcoin ETFs will inspire the development of similar products.

Nevertheless, he warned that if the momentum is slowed, ETF providers may alter their focus or discontinue underperforming ETFs due to a lack of demand.