Galaxy Digital’s income reaches record levels of up to $422 million thanks to mining, raised by 40% in 2024.

Galaxy Digital disclosed a prosperous initial quarter of 2024, during which net income surged to $422 million, representing a 40% increase over the preceding quarter. Record earnings in mining and management fees aided the expansion.

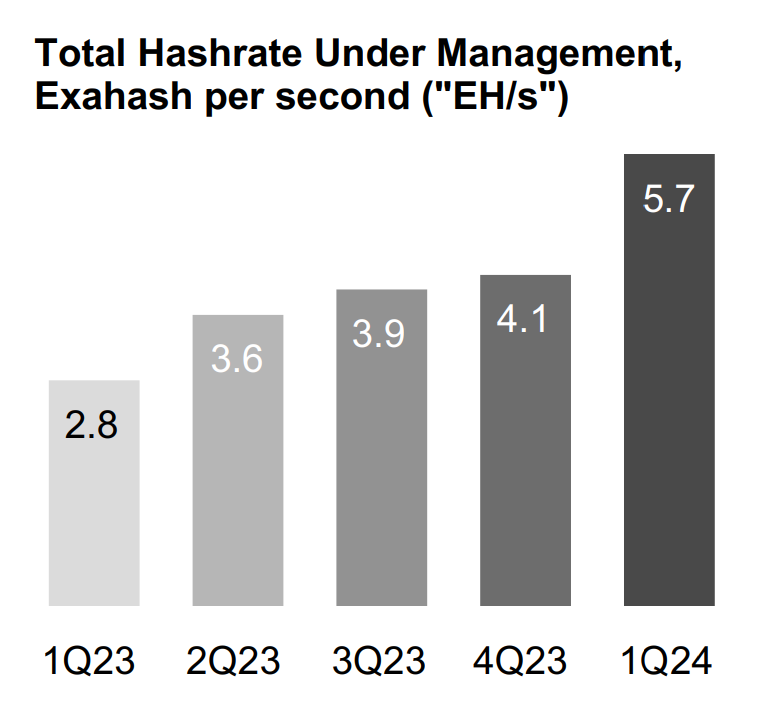

As per the organization’s statement, the mining activities yielded an unprecedented revenue of $31.5 million, an increase of 69% compared to the preceding quarter. Its expansion of mining capacity was the primary driver of its development, as evidenced by its hash rate under management (HUM) of 5.7 exahash per second (EH/s).

Galaxy mined 373 Bitcoins at an average cost of less than $19,500 throughout the quarter.

Additionally, the company’s asset management performed admirably during the initial quarter. The record-breaking management and performance fees increased by 113% to $17.8 million in the current quarter.

Galaxy Digital and Invesco introduced an exchange-traded fund (ETF) in January to spot Bitcoin in the United States. In April, the organization augmented its range of Bitcoin and Ethereum on the European market by introducing two exchange-traded commodities (ETCs) in collaboration with DWS Group.

The 78% increase in revenue from trading operations to $66 million was driven primarily by gains from derivatives and positive asset price movements. Galaxy disclosed that its loan book experienced an average increase in value to $664 million.

As of March 31, 2024, Galaxy had amassed assets under administration amounting to around $7.8 billion, representing a substantial 241 percent year-over-year growth and a 50 percent surge compared to the preceding quarter.

Its equity capital increased by 22% quarter-over-quarter to reach $2.2 billion, reflecting substantial expansion. In the first quarter, assets under stake increased by 100 percent, reaching $1.5 billion, as Galaxy advances toward becoming the second largest validator on the Solana network.

In April, the organization secured an estimated $125 million in funding. Galaxy intends to use the capital to improve the infrastructure of its West Texas-based Helios mining facility. Helios’s existing infrastructure can accommodate 180 megawatts, whereas Galaxy has been authorized to construct an additional 800 megawatts at the location.