Goldman Sachs plans to spin out its crypto platform, focus on tokenized assets, and partner with Tradeweb to expand blockchain-based financial products.

The investment bank corresponds with possible partners to expand the platform’s functionality and create new products.

According to a Bloomberg story published on November 18, Goldman Sachs is preparing to spin out its cryptocurrency platform to establish a new business dedicated to developing and trading financial instruments on blockchain networks.

According to Mathew McDermott, global head of Digital Assets at Goldman, the investment bank is talking with possible partners to expand the platform’s functionality and create new products, he told Bloomberg.

According to reports, one of the new entity’s strategic partners would be the electronic trading platform Tradeweb Markets.

According to McDermott, the spinout should be finished within the next 12 to 18 months if regulatory permits are obtained. According to reports, plans are still in their infancy.

“Having something owned by the industry is best for the market,” McDermott told Bloomberg.

Following “a major uptick in interest from clients” in cryptocurrency, McDermott stated in July that Goldman Sachs is getting ready to introduce three new tokenization products later this year in the US and Europe.

According to the report, McDermott stated that Goldman Sachs would concentrate on the “fund complex” in the US and European debt markets and intend to establish marketplaces for tokenized real-world assets (RWAs).

He said that the investment bank will only use permissioned blockchains and that its new products are intended for financial institutions rather than individual investors. According to him, the RWA marketplace will distinguish itself apart by accelerating execution and broadening the range of assets that can be pledged as collateral.

McDermott credited the continued growth of exchange-traded funds (ETFs) for digital assets with the “renewed momentum in crypto.”

Following US regulators’ ultimate approval of the investment vehicles in January, about a dozen BitcoinBTC$92,471ETFs have gone public. Regulators approved several spots for EtherETH$ 3,147.25 ETFs for listing on US exchanges in July.

In 2024, Goldman Sachs was one of the biggest purchasers of Bitcoin ETFs.

Tokenized real-world assets (RWAs) that provide low-risk yields from T-Bills and other money market products are in high demand.

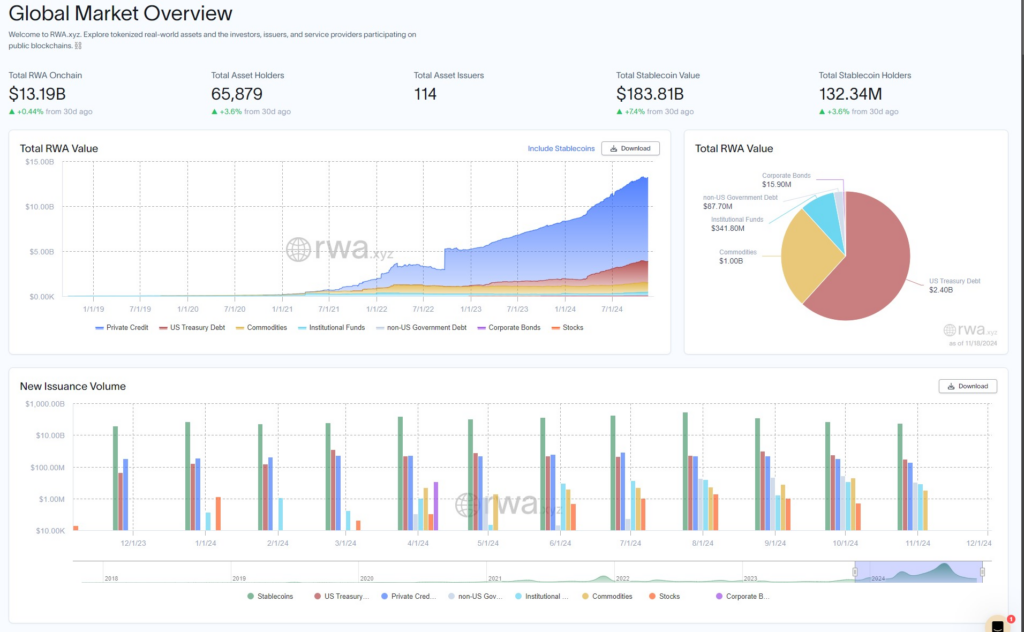

As of November 14, the total value locked in tokenized US Treasury debt was at $2.4 billion, according to RWA.xyz.