Grayscale Ethereum Trust recorded its first zero-outflow day as a spot ETF, coinciding with a surge in activity on Ethereum and its layer-2 networks.

With today’s announcement, the Grayscale Ethereum Trust (ETHE) has experienced its first day of zero outflows, capping a run of daily outflows since its inception.

It coincides with increased on-chain activity observed in Ethereum and several layer-2 networks.

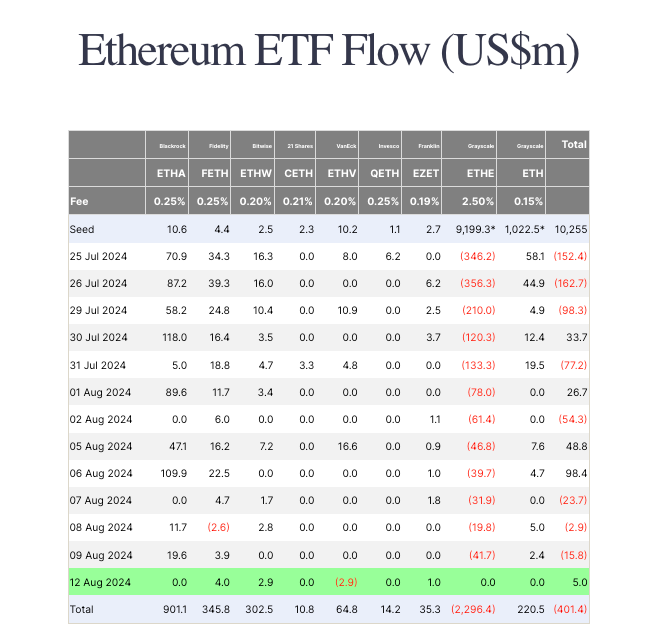

According to Farside data, Ether ETH$2,650 exchange-traded fund (ETF) flows became positive on August 12 for the fifth time since its introduction on July 23. This was made possible by ETHE reporting its first day of zero outflows.

Since its introduction, ETHE has lost around $2.3 billion in Ether.

In the two and a half weeks since the ETFs went live, ETHE, which had $9 billion worth of ETH on its books before its conversion, has sold off more than 25% of its overall holdings.

By contrast, it took nearly four months for Grayscale’s Bitcoin Trust (GBTC) to experience its first day of non-outflow.

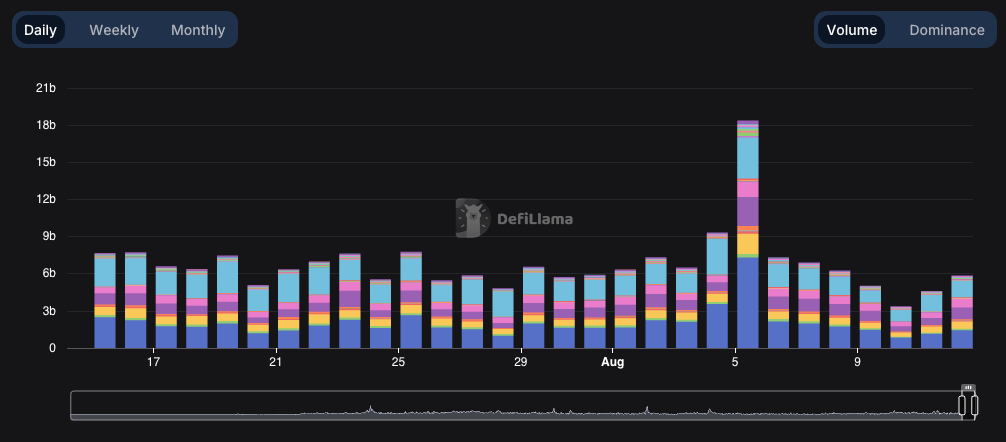

Remarkably, Grayscale saw its first day without any withdrawals after a sudden surge in activity on the Ethereum network, namely on its layer-2 networks and decentralized exchanges.

DefiLlama data shows that trading volumes across Ethereum and Base increased by 12% and 11% over the last 24 hours, while trading volumes across Solana-based DEXs decreased by 10%.

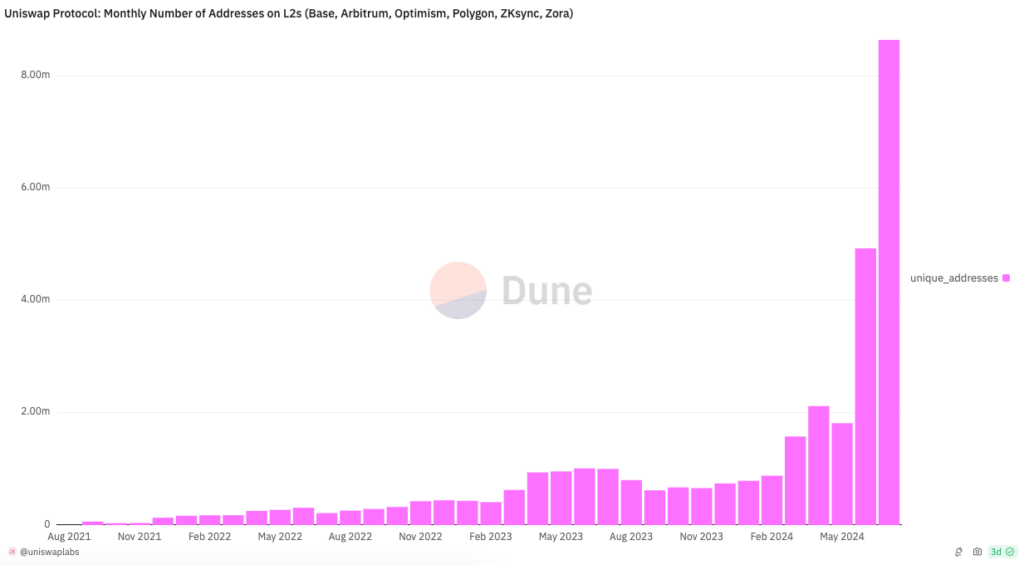

An unprecedented number of new L2-based addresses are being created monthly on the Ethereum-based DEX UniSwap, indicating that activity on Ethereum’s Layer-2 networks has also increased.

According to Dune Analytics statistics, Uniswap saw 8.65 million new addresses created across layer-2 networks in July, almost twice as many as the 4.93 million added in June.

Leon Waidmann mentioned that Base and Arbitrum claimed to have 2.64 million and 1.37 million weekly active users, respectively, in a post on August 9 to X.

According to L2Beat data, on August 12, 73 Ethereum layer-2 networks reported 298 transactions per second (TPS) of network activity. This is only 34 TPS less than the previous all-time high of 322 TPS, attained on July 18.

With $85 billion in TVL on its mainnet, Ethereum boasts a total value locked across all its L2s of $37.7 billion.

Reduced outflows serve as a positive stimulus.

Several analysts have cited reduced ETHE outflows as one of the main positive drivers of Ether’s price in the upcoming months.

They predicted that the price of ETH would follow the path of Bitcoin, which peaked at BTC$59,347 after its spot ETF approvals and saw significant withdrawals from the Grayscale Bitcoin Trust (GBTC).