India uncovers $97M in unpaid crypto taxes; Binance faces an $85M penalty, while WazirX and others pay $14M in recovered GST amid ongoing investigations.

According to the minister, Binance still needs to pay its $85 million tax evasion penalties, while India has recovered $14 million in goods and services tax from cryptocurrency companies like WazirX.

Significant amounts of unpaid goods and service taxes (GST) by prominent cryptocurrency exchanges, such as Binance and WazirX, have been discovered by the Indian government.

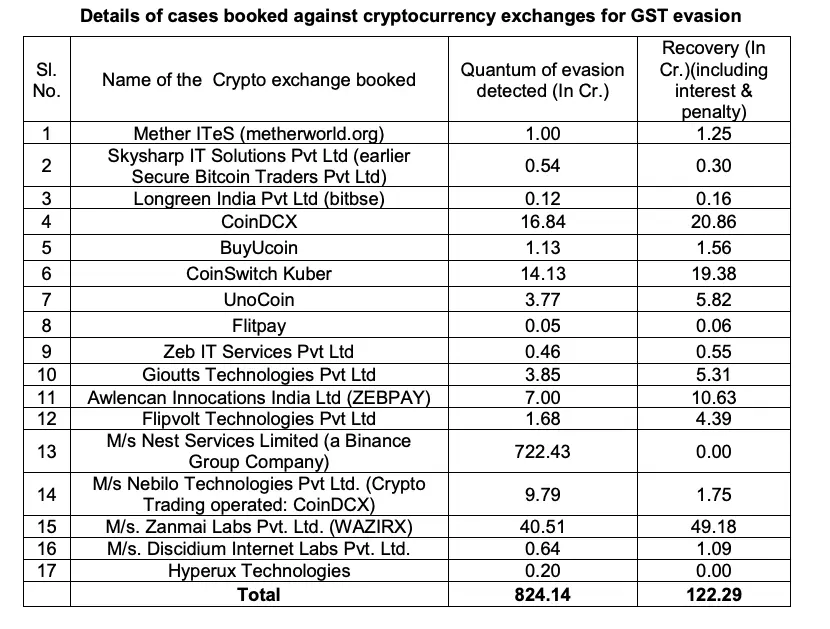

According to The Economic Times on December 3, India’s Minister of State for Finance, Pankaj Chaudhary, stated that the government has discovered 824 crore Indian rupees ($97 million) in GST in unpaid taxes by multiple cryptocurrency exchanges.

According to reports, authorities have opened similar investigations into cryptocurrency exchanges, such as CoinDCX, CoinSwitch Kuber, and WazirX.

The report was released a few months after Indian law enforcement ordered in August that Binance pay 722 crore Indian rupees (about $85 million) in overdue taxes.

WazirX and others pay 14% of the unpaid GST that India has recovered.

In response to a parliamentary question on December 2, Chaudhary stated that the Indian government had already recovered 122.3 crore rupees ($14 million) in taxes, penalties, and interest as part of the ongoing crackdown.

The statement listed 17 cryptocurrency companies that were discovered to have engaged in GST evasion, including CoinDCX with 16.84 crore rupees ($1.9 million), CoinSwitch Kuber with 14.13 crore rupees ($1.7 million), and WazirX with 40.5 crore rupees ($4.8 million) in unpaid GST taxes.

WazirX has paid 49.18 crore rupees ($5.8 million), 20% more than the GST amount the company was accused of failing to pay, plus fines and interest.

Chaudhary claims that Binance has not paid the fine.

According to Chaudhary’s statement, some listed companies, such as Binance and Hyperux Technologies, have yet to settle with the authorities, even if most of the listed companies have paid the penalty.

Since its recovery payment is not included in the 122.3 crore rupees recovered overall, Binance does not appear to have recovered its 722 crore GST tax fraud.

“We still have a tight working relationship with regulatory bodies and participate in hearings as needed to answer any queries or concerns. A representative for Binance informed Cointelegraph, “Binance is still responsive, cooperative, and committed to addressing all necessary tax inquiries.”

A WazirX representative claimed the tax evasion case started because the “GST law on cryptocurrencies was unclear in India.”

According to the nation’s anti-money laundering regulations, 47 virtual digital asset service providers have been registered as reporting companies with the Financial Intelligence Unit.