Michael Saylor urged Microsoft’s board to adopt Bitcoin, arguing it will surpass gold and art in global wealth value. He highlighted Bitcoin‘s performance, noting it has outpaced Microsoft stock by 12 times annually.

As previously stated, Michael Saylor, the Executive Chairman of MicroStrategy, presented the Bitcoin strategic reserve to the boards of Microsoft (MSFT) on December 1. He emphasized that Bitcoin is a digital capital transformation, and they must incorporate it into their balance sheet within the next few years.

By the next two decades, Bitcoin is expected to surpass gold and art, which are projected to account for $45 trillion and $110 trillion of global wealth, respectively, and become one of the world’s largest assets, with a total value of $280 trillion.

In addition, Saylor observed that Microsoft’s shares were surpassed by Bitcoin’s price movement by 12 times annually, indicating that the company required digital capital to operate. Shares of MicroStrategy (MSTR) increased by 3,045% following the acquisition of Bitcoin in recent years, while MSFT only performed at 103%.

“Bitcoin is the best asset that you can own. The number’s speaks for themselves. It is make alot more sense to buy Bitcoin than buy your own stock back, or to hold Bitcoin rather than holding bonds. If you wanted to outperform you gotta need Bitcoin,” Saylor mention on his presentation posted on YouTube.

Microsoft has also recognized that Bitcoin’s widespread adoption in the coming years will be facilitated by political and market support, as evidenced by the Bitcoin ETF’s products in the stock market and Trump’s administration.

Michael Saylor offers a variety of options.

Saylor presents the Microsoft board with a decision: either adhere to the traditional financial strategy, which is sluggish to expand and increases investor risk, or innovate the strategy by embracing the future of Bitcoin, which has accelerated growth.

Additionally, he provides Bitcoin24 to the boards, which customizes Bitcoin products for corporations. He predicts that Microsoft shares will increase to $584 from their current price.

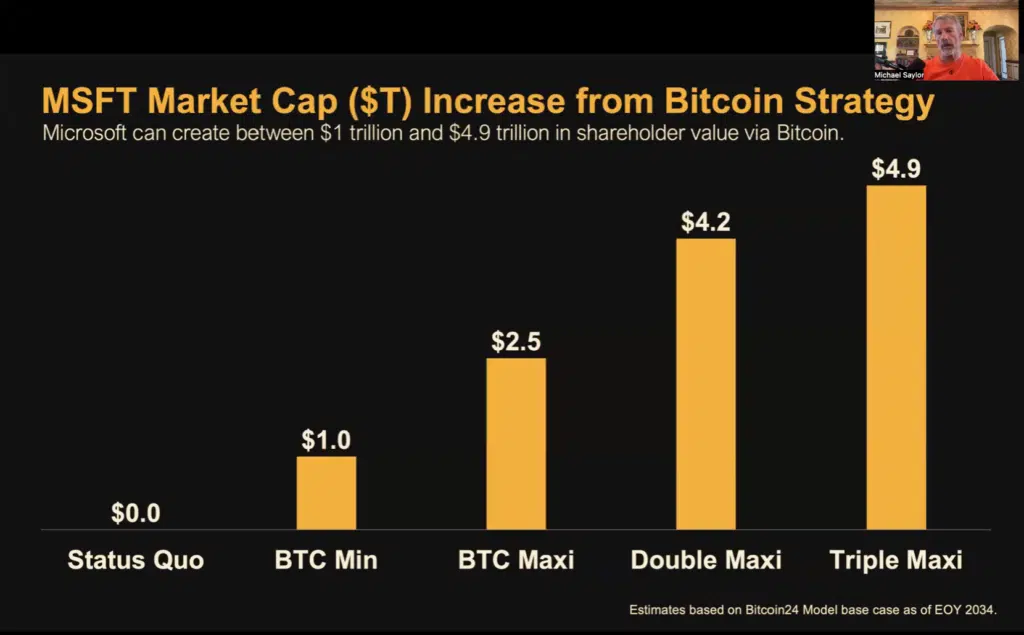

If the company implements Bitcoin’s strategic reserve, its market capitalization will also increase by $1 trillion to $4.9 trillion per share.

The risk associated with Microsoft shares is expected to decrease from 95% to 59%, and annual recurring revenue is expected to increase from 10.4% to 15.8%, as a result of the value generated by the adoption of Bitcoin.