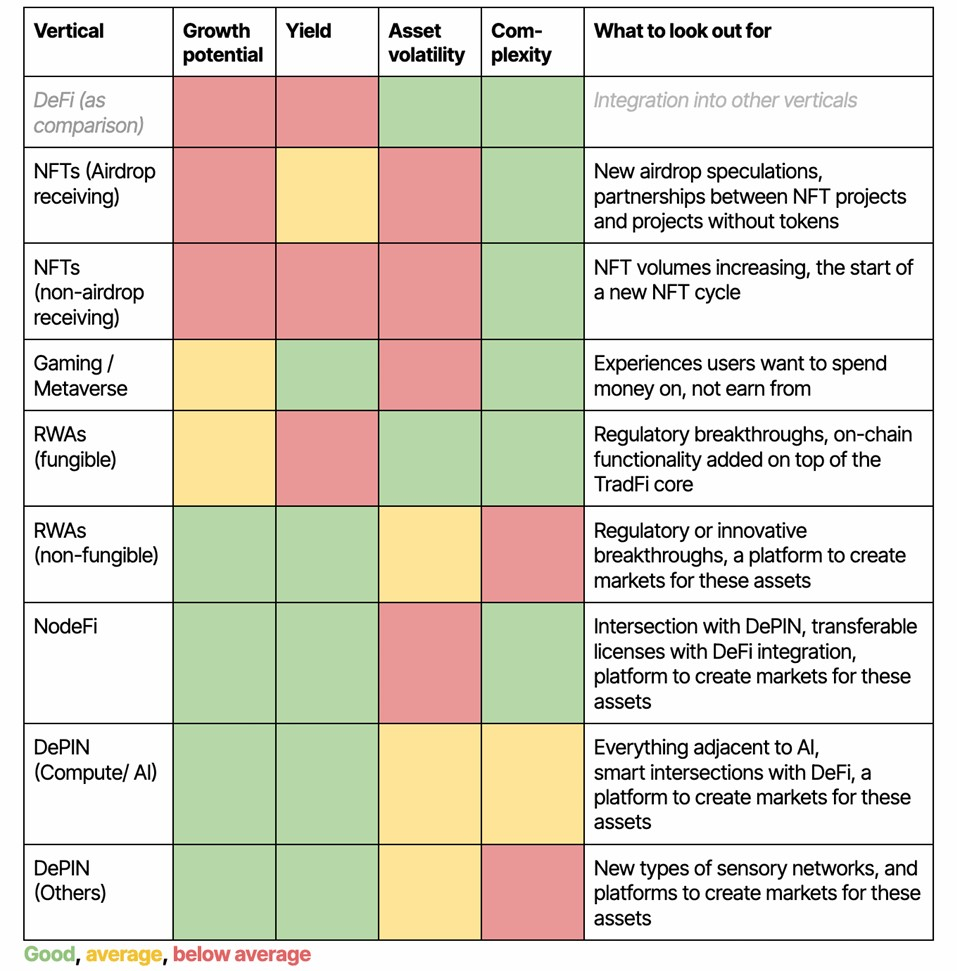

Nansen’s report highlights DePIN and NodeFi as potential top DeFi sectors, fueled by AI, GPU-as-a-service, and distributed computing growth.

According to the report, DePIN and NodeFi could become the most lucrative verticals for decentralized finance.

Two of the most active verticals in the decentralized finance space could include artificial intelligence (AI) and the growing “NodeFi” market, according to a report by Ethereum blockchain analytics platform Nansen and lending protocol MetaStreet.

The paper, released on October 14, argues that the markets for cryptocurrencies are “evolving beyond their initial focus on ERC-20 tokens and DeFi” and that these will eventually reach a tipping point.

As the generative AI market develops, emerging and developing blockchain-based verticals like distributed computing and GPU-as-a-service initiatives should see comparatively rapid growth.

DePINs exhibit expansion

The report states that decentralized physical infrastructure network (DePIN) projects are the vertical with the most development potential.

Decentralized energy distribution and data storage are two examples of DePIN projects. Programs using GPU-as-a-service and distributed computing can also benefit from the use of DePIN.

The report, which references research from Fortune Business Insights, states that the total market value of GPUs-as-a-service, or distributed graphics processing units, was $3.2 billion in 2023.

Artificial intelligence model training is primarily used for GPU-as-a-service clusters, suggesting that demand will rise in 2024 and beyond.

According to the report:

“Overall, AI-related compute DePIN appears to be in a prime position to become the next major vertical, with a sizeable and fast-growing market, high yield potential, predictable asset prices, and comparatively low implementation complexity.”

According to a recent study, the generative AI boom has resulted in significant expenditures throughout the entire AI technology stack, even though leading enterprises remain profitable.

The report states that the areas where blockchain and AI overlap have the most long-term promise, even though there’s no assurance that blockchain-based businesses would attract most investors.

It also mentioned the possibility of the NodeFi sector, a market for node operators’ incentives, taking off. However, unlike the AI industry, which is booming, NodeFi’s profitability depends on specific projects.