Bravos Research claims that as a decline in the price of Bitcoin to $80,000 becomes a real risk, outflows from BTC ETFs are only one obstacle for bulls.

Bravo Research, an investment research firm, believes that around $80,000, Bitcoin would be a “buy the dip” opportunity.

Its most recent macro report, “Is the 2025 BTC crash starting?” was released on December 31. Bravo cautioned that the “parabolic” price strength of Bitcoin (BTC) at $96.479 could decline by the beginning of 2025.

Report: The price of BTC might track the “weakness” of stocks.

As the new year begins, BTC faces new challenges, as the price of BTC/USD remains below $100,000.

Bitcoin’s bull market exuberance has been dampened by record outflows from the most prominent US spot BTC exchange-traded fund (ETF), declining stock market performance, and a more hawkish Federal Reserve.

Bravos believes that even if the price of BTC is “unquestionably in the parabolic stage,” a rebalancing in its performance may now be imminent.

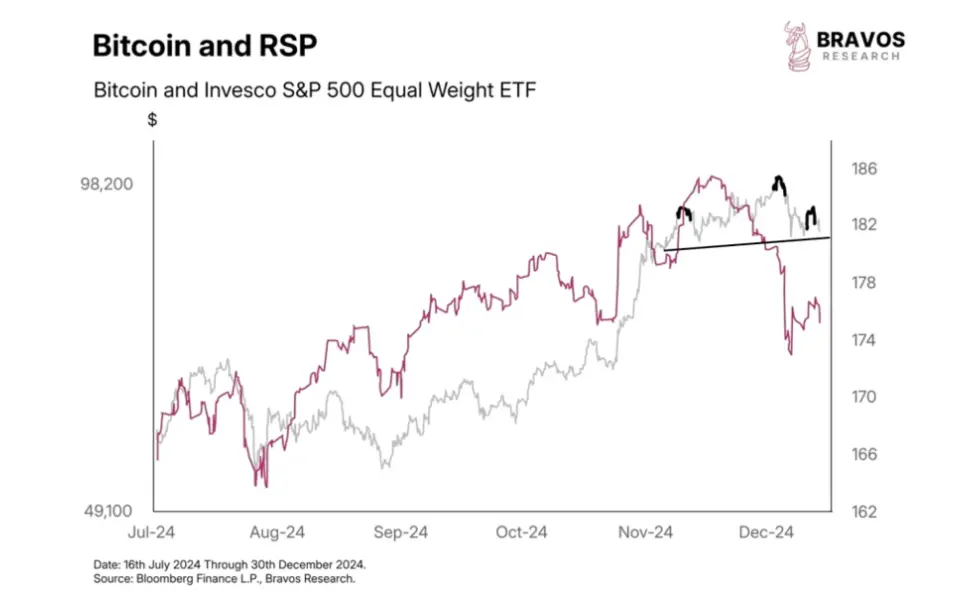

This contrasts with the situation in September 2024, when markets reached all-time highs and Bitcoin faltered. According to the survey, BTC eventually overtook the strength of stocks at that time.

“Now, we might see Bitcoin catch down to stocks’ weakness.”

The accompanying chart showed a significant divergence in December between the BTC/USD and S&P 500.

Bravos Research stated, “We would look to buy the dip around $80,000 for the next leg higher if BTC corrects.”

In recent weeks, several BTC price targets have surfaced, with $80,000 becoming increasingly popular, as Cointelegraph reported.

Do not rely on the flows of Bitcoin ETFs.

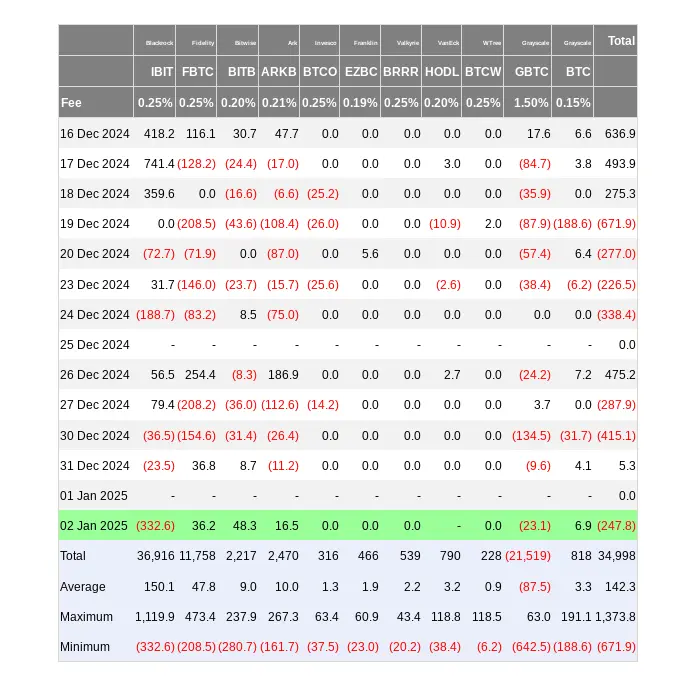

Even though BlackRock’s iShares Bitcoin Trust (IBIT) had not yet seen a sell-off for the new year at publication, the paper dissected how ETF performance affected pricing.

Currently, Bitcoin ETFs own 1.15 million BTC, and they continue to add over 3,000 BTC daily. In 50 days, BTC might increase by another 50% at this rate, according to academics’ calculations.

“However, even a slight slowdown in ETF buying could trigger a decline.”

Given how things transpired during their first year of trading, BTC/USD might not follow suit even if ETF flows would revert positively.

“For example, even though ETFs were still purchasing BTC in March 2024, the cryptocurrency price dropped by 30%,” Bravos continued.

“So, March 2024 was a great time to sell, despite Bitcoin ETFs still accumulating.”