SBI Holdings’ 320M XRP ($703M) transfer sparks talk of its use as a bridge currency for SBI Remit’s fast, low-cost global payments.

The transfer of $703 million in XRP by SBI Holdings, a long-standing partner of Ripple, has sparked speculation. The action has sparked curiosity regarding its motivation, particularly in anticipation of Ripple’s forthcoming 1 billion XRP escrow release. Rumors suggest that the platform’s relocation is associated with custodial restructuring, as the initial destination wallet is believed to be a novel creation.

SBI Holdings moves 320 million XRP

Whale Alert disclosed the transfer of a substantial 320 million XRP, which is estimated to be worth $703 million, in a recent X post. At first, the transaction was reported between unidentified wallets; however, subsequent investigations revealed that the source was SBI VC Trade, a subsidiary of SBI Holdings and Ripple’s partner.

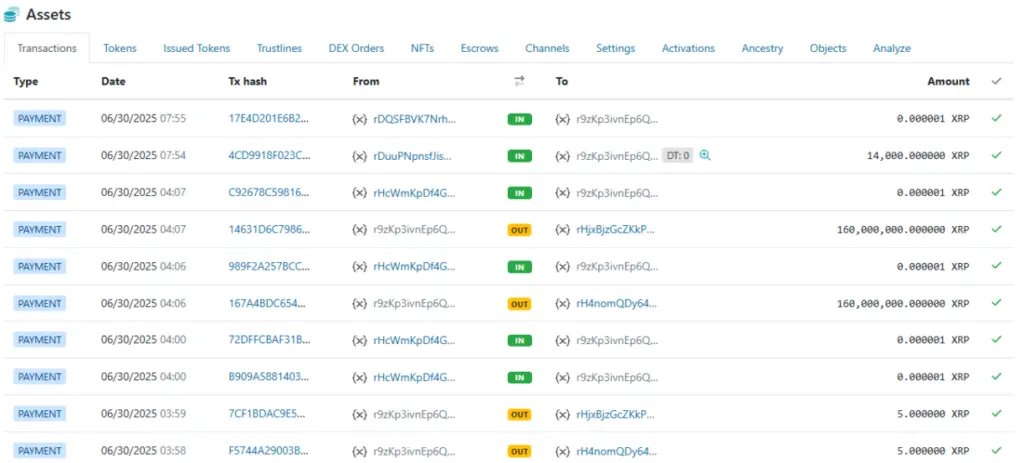

According to reports, the wallet rNR…6jS transferred these substantial XRP tokens to the wallet r9z…RCZ. Furthermore, two transactions totaling 160 million XRP were reported to distinct wallet addresses.

In the aftermath of this transaction, the price of XRP has experienced a significant increase, with a surge of over 8% in the past week. The token has increased by 2.5% in a week despite a 24-hour decline of 0.46%. The trading volume has also increased by an astonishing 37%, currently at $1.91 billion.

On July 1, Ripple will unlock one billion XRP

Significantly, the timing of SBI Holdings’ XRP transfer, which coincides with Ripple’s forthcoming escrow release, has sparked speculation and raised eyebrows. According to reports, Ripple is scheduled to release 1 billion XRP tokens from its escrow on July 1, 2025, as part of its consistent monthly schedule that commenced in 2017.

The platform released 1 billion XRP tokens from escrow in June, which were estimated to be worth $2.21 billion. CoinGape reported that the company unlocked 1 billion tokens in three transactions in May, which amounted to 500 million, 300 million, and 200 million XRP.

Concerns are raised regarding SBI Holdings’ token transaction, as the subsequent release is scheduled for July 1. Although the objective of the action remains unclear to many, some consider it to be a positive indication of the future price potential of XRP. The simultaneous occurrence of these two events has generated much speculation among investors and analysts regarding the potential market implications.

Why is it necessary to transfer XRP at this time?

According to reports, the initial destination wallet (r9zKp3…) was generated on June 30. This implies that the wallet is a new internal account, potentially intended for strategic reallocation or custodial structuring.

The timing of the transfer, which coincides with Ripple’s scheduled escrow release, implies that SBI’s move may be more than a routine adjustment, even though it opens up a wide range of possibilities.

The transfer’s magnitude and the creation of a new wallet imply a significant strategic decision, potentially linked to SBI’s plans to utilize XRP as a bridge currency or its preparations for institutional services. As the cryptocurrency landscape continues to evolve, SBI’s actions could have implications for XRP’s adoption and market dynamics.

Intriguingly, SBI is employing XRP as the default bridge currency for payments. According to Japan’s explicit regulatory framework, XRP is classified as a crypto asset rather than a security. Ripple and SBI can develop XRP-based solutions in a stable environment exempt from the legal uncertainty present in the United States.

Could this be a positive development?

Investors in XRP have no reason to be concerned about the SBI Holdings transfer. Even though the $703 million transaction raised eyebrows due to its magnitude and timing near Ripple’s 1 billion XRP escrow release, it is an internal initiative to finance strategic allocations or custodial restructurings.

Moreover, the trading volume and price of XRP have increased, indicating an initial positive/neutral market reaction. The asset’s long-term confidence is also evidenced by SBI’s continued use of XRP and Japan’s positive regulation.