Scott Painter, a serial entrepreneur, has failed to realize his ambition to establish an all-electric vehicle subscription company, Autonomy

Therefore, he is once again transitioning to what he refers to as the “most challenging build” of his career.

Painter informs TechCrunch in an exclusive interview that he is establishing a new company, Autonomy Data Services, or ADS, even though Autonomy will continue to operate the small 1,000-car fleet it has assembled over the past few years, which is far from the stated objective of 23,000.

The new company will offer a software platform and data to manufacturers who wish to operate their subscription services for electric, gas, new, or even used cars. Painter also reports that he is in discussions with fleet operators, vehicle dealers, and companies selling construction and farm equipment but may be interested in offering subscriptions. He claims that an early iteration of the service is already generating revenue.

According to Painter, ADS is currently negotiating with numerous manufacturers, three of which have previously operated their subscription service. The company is collaborating with Deloitte to operate the service. ADS will receive a revenue share as the software-as-a-service provider, while Deloitte will charge the automakers (or other clients) to customize the platform.

It is another triumph for Painter, who has endured a difficult few years. In 2015, he founded Fair, a vehicle leasing startup that received over $300 million from SoftBank after stepping down as CEO of auto retailer TrueCar, which he founded in 2005. The outcome was unfavorable, as early investors accused SoftBank of destroying the company, and Painter ultimately resigned as chairman in 2021.

The most recent pivot that he made was also not a simple one.

Painter was required to persuade Autonomy’s investors, some of whom were in financial distress due to the subscription service’s failure to materialize as anticipated, to initiate all of this.

“Our lenders had senior secured status; they could have liquidated the fleet and killed the company to recoup some of their investment,” he asserts. However, he collaborated with them to convert $32 million in debt in Autonomy into equity in ADS.

He also claims that he was required to “personally dig deep,” which involved the sale of a $6 million beach mansion on the Pacific Coast Highway, the mortgage of another property, and the “sale of a bunch of assets that I didn’t want to sell.”

He describes the process as “hugging the cactus,” stating that it has been the most challenging construct he has ever experienced as an entrepreneur.

A six-figure acquisition deal for data

The value of the small fleet, primarily Teslas, was obliterated by Elon Musk’s aggressive price cuts, which took place last year when Autonomy was already struggling. (Painter, who is acquainted with Musk personally, has attempted to “emphasize to Elon the significance of being more consistent in his discounting practices,” but to no avail.)

This time, the issue is that nearly all leading automakers have already implemented subscription services. Furthermore, nearly all of them abandoned the concept.

Painter said this occurred because manufacturers “lacked the fidelity or comprehension of how subscriptions would operate.” He claims that the automakers were unaware of their consumers’ behavior because all of the subscription services were new. Would they be willing to subscribe for a limited period? Or a few years?

Painter contends that the absence of this information renders it exceedingly challenging to determine pricing. Consequently, manufacturers implemented substantial subscription fees, which served to discourage consumers.

One of the services he intends to provide with ADS is this type of information. This is not the case for Autonomy customers alone. The assets of the bankrupt used car marketplace Shift Technologies were discreetly acquired by Painter earlier this year for less than one million dollars. In the years preceding its collapse, Shift had acquired Fair, Painter’s former car-leasing startup, which had previously acquired Ford’s subscription service, Canvas.

This acquisition brought the remnants of Painter’s former business back under his ownership and Uber’s leasing service, Xchange.

According to Painter, all those companies’ data can be utilized to forecast “the duration of time individuals spend in cars based on their customer cohort, FICO score, income, and so forth.” This is significant because it provides assurance and because the adaptability of subscription services appeals to customers with lower credit scores.

Painter claims that he acquired all the source code, patents, trademarks, compliance, and legal “work product” from the defunct businesses and the customer data. He believes this will facilitate ADS’s ability to establish a customer presence in new markets.

He stated that he obtained over one terabyte, sarcastically referring to it as an “astonishing avalanche of s—.”

“My IT team was merely asking, ‘What are you going to do with all of this?'” As he puts it, “It just kept coming.” However, he emphasizes that the organizations that produced this data “collectively invested nearly a billion dollars in the development of software” that he currently owns and employs at ADS.

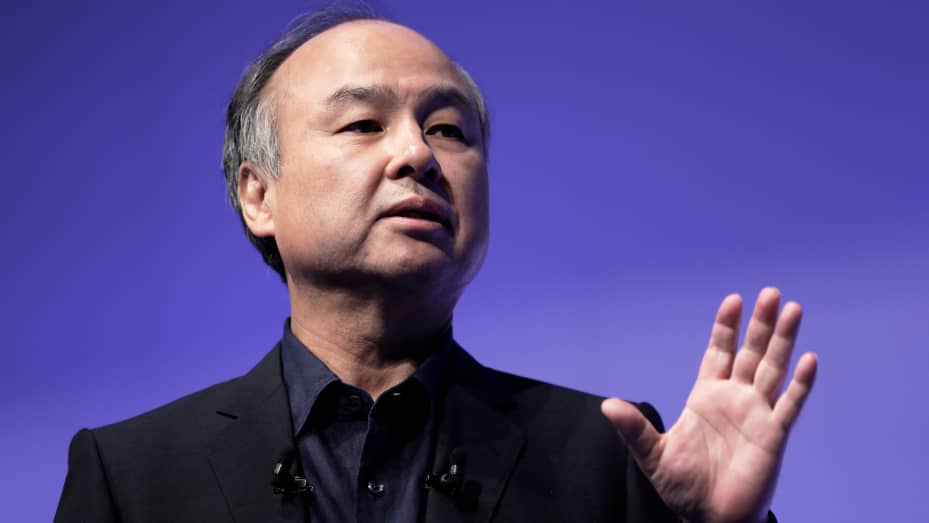

“When [SoftBank CEO] Masayoshi Son discovers that I acquired all of the Fair IP and assets for less than a million dollars, it’s just, it’s going to kill him,” he jokes.

Additionally, he has amassed $2.5 million to support the endeavor; however, the task remains incomplete. “We have taken all necessary steps to ensure that [ADS] is an investable business.” “At present, we are merely searching for an equity partner who will contribute between $5 million and $8 million,” he stated. “That will provide the company with a two-year runway to subsequently scale in conjunction with Deloitte.”