Stablecoins increasingly affect the financial ecosystem, and traditional remittance behemoths like Western Union and MoneyGram find staying up challenging.

Amid dwindling app downloads for established companies, stablecoins revolutionise remittance by providing quicker, less expensive cross-border payments.

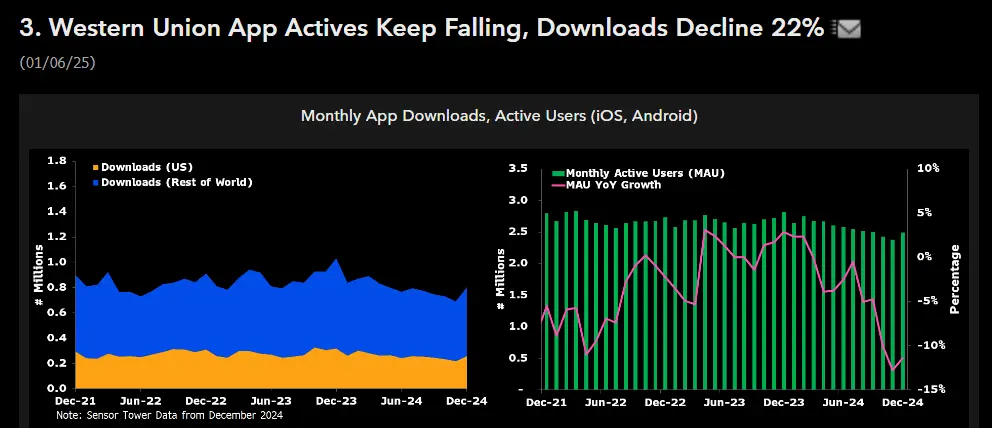

Downloads of the major remittance apps have drastically decreased, with MoneyGram and Western Union witnessing drops of 27% and 22%, respectively, according to Matthew Sigel, Head of Digital Assets Research at VanEck.

This decline, however, extends beyond app downloads. Since 2021, fewer than 3 million monthly active users (MAU) have been using these services. These platforms saw consistent drops in user activity between January and November 2024, indicating a change in consumer behaviour.

Stablecoins’ ascent

According to Sigel, stablecoins are becoming a potent substitute for conventional remittance systems since they make cross-border transactions quicker, less expensive, and more manageable.

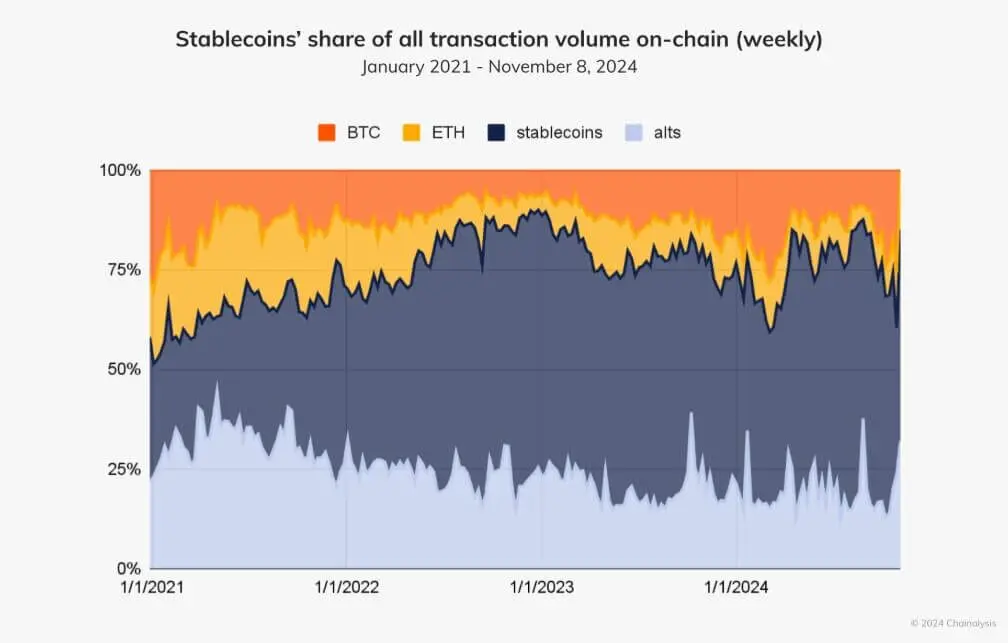

These digital assets, which are based on solid values like the US dollar, have become essential in areas with unstable currencies or no access to trustworthy financial systems, according to a report by blockchain analysis firm Chainalysis.

Stablecoins are becoming increasingly prevalent worldwide as they cover the holes created by more established financial services. They are used by both individuals and companies to effectively manage liquidity, safeguard money from exchange rate swings, and make foreign payments.

They allow for rapid transfers, avoiding the delays and exorbitant costs of regular banking.

The stablecoin market achieved a significant milestone in 2024 when its capitalization surpassed $200 billion. Additionally, the industry witnessed the emergence of cutting-edge digital currencies like Ethereum’s synthetic USDe stablecoin, which currently faces competition from big players like Tether (USDT) and Circle (USDC).

Furthermore, the sector is remarkably profitable; issuers such as Tether and Circle made over $664 million last December, accounting for a sizeable amount of money crypto protocols make.

Additionally, Chainalysis noted that more than 75% of the billions in cryptocurrency transactions documented in recent months are due to stablecoins.

Traditional banking institutions and blockchain startups like Ripple have taken notice of this impressive growth and are looking into methods to get into this expanding sector.

In light of this, Liz Bazurto, MetaMask’s ecosystem engagement manager, stated that the established remittance behemoths may adopt stablecoin payments for their businesses. She stated:

“I can see a path for Western Union and MoneyGram to enable stables. MoneyGram has enabled Stellar (USDC) for on and offramps.”