In June, the Supreme Court struck down the Chevron theory, severely weakening the Securities and Exchange Commission’s defense against cryptocurrencies.

What’s the connection between truck stops, fishing boats, and the Securities and Exchange Commission (SEC)? If you have followed the recent rulings of the Supreme Court of the United States (SCOTUS), then quite a bit.

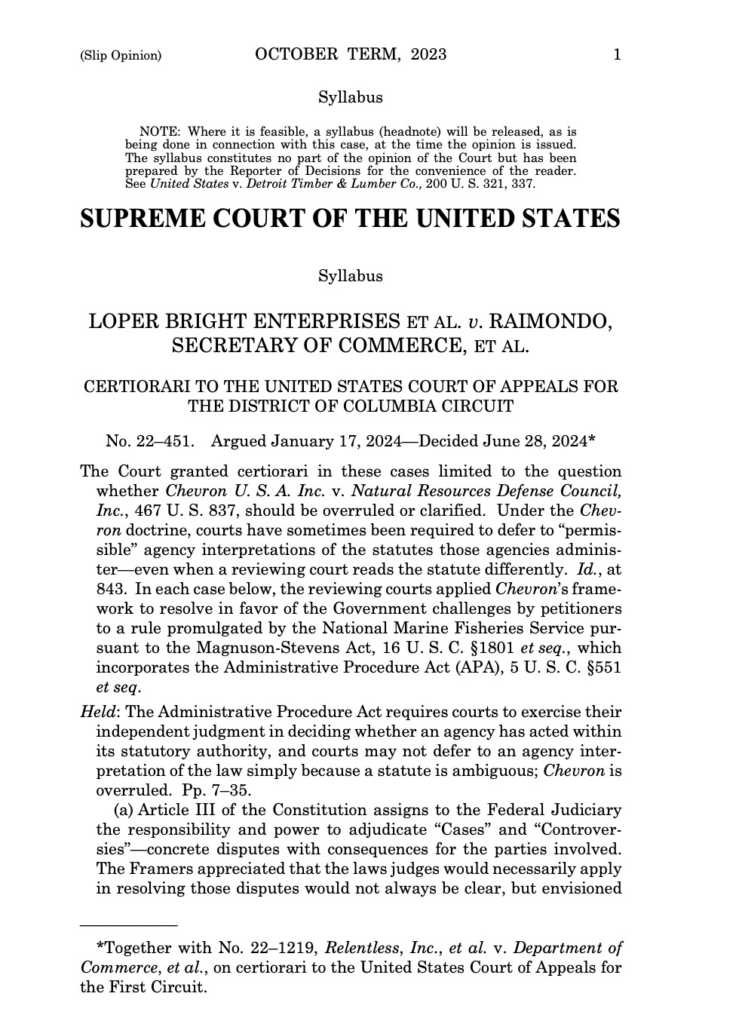

The United States Supreme Court delivered a decision on June 28 in the case of Loper Bright Enterprises v. Raimondo, which is expected to be a turning point in the federal government’s ability to regulate Internet businesses. The ruling established two new avenues for challenging federal agencies that have attempted to extend their authority to cryptocurrency.

Cryptocurrency firms have been battling for years to emerge from a regulatory limbo. Organizations, including the Treasury Department, the Commodities Futures Trading Commission (CFTC), and the Securities and Exchange Commission (SEC), have all attempted to increase their presence in this quickly changing sector. Compliance difficulties confront most firms, with cryptocurrency having the most.

For instance, the legal environment presents a combination of insufficient incentives and retrograde defaults for firms advancing decentralized finance (DeFi). Regulators are still determining how to categorize DeFi services even though DeFi has the potential to drastically increase financial access for the unbanked and revolutionize our financial system. They are occasionally handled similarly to conventional financial products. Occasionally, they aren’t. This ambiguity makes it challenging for DeFi entrepreneurs to function legally. Despite these obstacles, this industry has experienced growth and innovation.

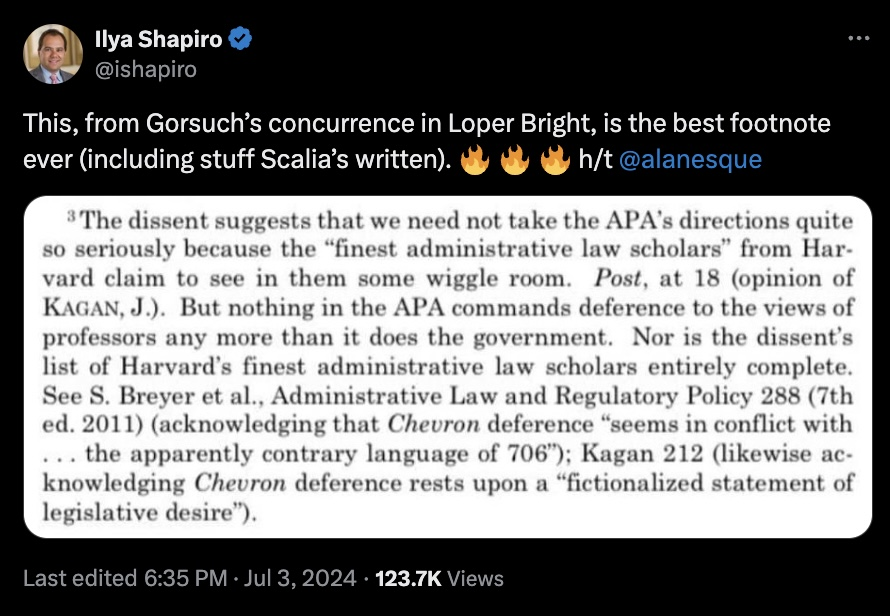

Additionally, for many years, federal courts assumed that agencies’ interpretations of ambiguous statutes were final and should never be questioned. This default, sometimes referred to as “Chevron deference,” meant that, for instance, courts would accept the Treasury Department’s interpretations of the Bank Secrecy Act’s ambiguities regardless of whether the court agreed with the interpretation.

All of this is going to change.

The Department of Commerce made Atlantic herring fishermen pay for expensive and inefficient monitoring systems that Congress had yet to approve explicitly. Hence, the fishermen filed a lawsuit against the department in 2020. The United States Supreme Court utilized its ruling in the case of Loper Bright Enterprises v. Raimondo on June 28 to overturn the Chevron deference and move federal agencies toward more clearly defined and constrained regulatory authorities. In the future, courts will no longer be constrained by decisions made by agency bureaucrats. Federal agencies now have to convince courts that they are correct in the same way as everyone else.

Even though Looper Bright altered the process by which agencies might create regulations, it allowed them to continue enforcing long-standing rules that had yet to be successfully contested before the statute of limitations ran out. Six years are allotted by federal law for broad challenges to regulations. Courts have understood the statute of limitations to start from the day the regulation was published for more than fifty years.

This implies that for cryptocurrency entrepreneurs, their day in court can only come about if someone else’s day in court has already occurred inside that time frame. For instance, it was almost hard for a business to contest a government agency’s enforcement of a thirty-year-old regulation today.

However, the Supreme Court made it clear in a ruling on July 1 when the six-year cap starts. A truck stop in North Dakota desired to contest the debit card transaction merchant fees regulations. However, since it wasn’t established until 2018, it missed the six-year window to file a challenge to these Dodd-Frank regulations by 2017, according to the prior reading of the statute of limitations.

In a decision that supported the truck stop, the Supreme Court of the United States ruled in Corner Post Inc. v. Board of Governors of the Federal Reserve System that the six-year statute of limitations began not when the rule was released in 2011 but rather when the truck stop began taking debit cards at the time it opened for business in 2018. This is a significant victory for startups operating in otherwise established regulatory contexts.

Combining these two rulings will strongly support fresh challenges to federal regulations. This is the time for startups to act. Though the Supreme Court may have examined truck stops and fishing boats, it also provided companies worldwide with robust new tools to fight against unjustified regulatory creep.

These two historic rulings have scarcely dried, and the long-term effects remain. It’s time to mold these cases’ legacy to help cryptocurrency and the forward-thinking startups that will propel us forward.