TeraWulf clears outstanding debt to allow the company to focus on scaling operations rather than keeping up with debt obligations in the post-halving era.

TeraWulf resolves outstanding debt to enable the organization to concentrate on expanding operations rather than maintaining debt obligations in the post-halving era.

On July 9, TeraWulf, a crypto mining company, disclosed that it had paid off its outstanding debt earlier than anticipated, with a final payment of $77.5 million.

TeraWulf executives stated that the debt reduction would enable the company to concentrate on deploying mining infrastructure and optimizing its resources rather than satisfying burdensome debt obligations.

TeraWulf’s early debt repayment is consistent with the company’s objective of optimizing shareholder value through organic growth strategies.

In a recent interview with Cointelegraph, TeraWulf’s chief strategy officer, Kerri Langlais, stated that the company was not actively seeking to expand through mergers and acquisitions. She cited the potential for sustainable shareholder returns due to improvements in operational efficiency and profit margins.

Miners get political

In June, executives from CleanSpark, Marathon Digital, Riot Platforms, and TeraWulf convened with former United States President Trump to address the challenges the mining industry faces. The Bitcoin Voter Project was established within 24 hours.

The Bitcoin Voter Project is a nonprofit organization that provides electors with information regarding Bitcoin. It is distinct from a political action committee (PAC) in that it prohibits endorsing specific candidates or running partisan campaign advertisements.

Capitulation of the miner

The mining industry continues to prioritize post-halving economics. The mining firms that cannot compete in the post-halving environment are at risk of being shut down due to the high energy cost required to mine Bitcoin and the reduced block subsidy.

Miner capitulation is when miners sell their holdings, reduce operations, or even liquidate entirely during market downturns. This process may be currently underway.

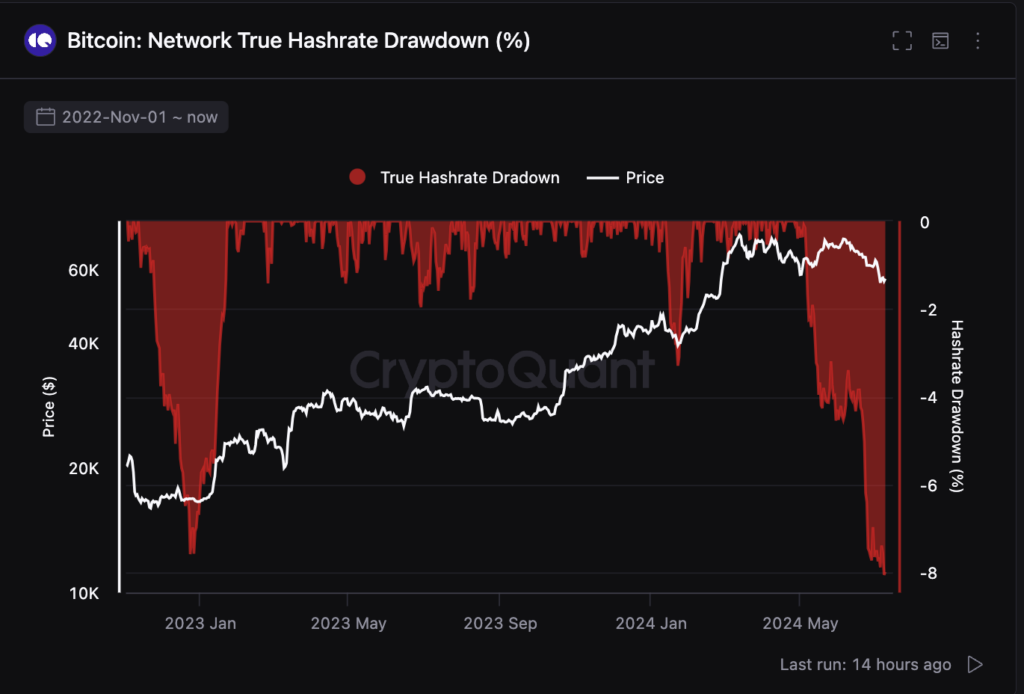

The ongoing decline in the Bitcoin hashrate, the total computing power that secures the Bitcoin network, indicates that miners are either scaling back operations or turning off outdated, obsolete mining equipment.

Nevertheless, the hashrate drawdown was accompanied by a corresponding decrease in mining difficulty, which reduced energy costs for mining companies. The mining difficulty of the Bitcoin network has decreased to 79.5 terahashes per second, the lowest level since March 2024, on July 5.