Torq raises $70M in Series C funding, boosting its AI-driven security automation platform. With a $24M ARR, its target is $100M by 2026 amidst rising threats.

The corporate world is becoming more interested in technology that might help automate responses to breaches as the number of cyberattacks rises. 80% of security leaders anticipated increased investments in security automation technology this year, according to a 2023 study by analytics firm Devo. Most respondents highlighted the technology’s ability to assist in mitigating cyber threats. By 2032, the security automation market will be valued at $26.6 billion.

Torq is one provider that has had extraordinary success using AI to abstract away laborious, repetitive security-related duties.

According to CEO Ofer Smadari, Torq’s annual recurring revenue (ARR) has surpassed $24 million, driven by a clientele that includes Procter & Gamble, Chipotle, PepsiCo, and Wiz.

He declared, “We are projecting $100 million ARR by fiscal year 2026, having tripled revenue over the past two years.” “Our platform serves nearly 900 enterprises globally through the services of dozens of partners and over 150 direct enterprise customers.”

Torq closed a $70 million Series C fundraising round earlier in September, probably partly thanks to this traction. With this round, which Evolution Equity Partners led, Torq has now received $192 million.

Favorable market circumstances also had a role.

According to Crunchbase, VCs invested $4.4 billion in cybersecurity companies in Q2 2024, making it the best funding quarter for the industry since 2022. In Q2 of 2023, funding increased by 144% year over year and 63% from Q1; around the same period, dealmaking nearly doubled compared to the first half of 2023.

“We already have internal efficiencies in place that power our operations, from R&D through go-to-market, as a result of growing responsibly,” Smadari stated. “We have developed our business in an extremely frugal manner.”

In 2020, Smadari founded Torq alongside Eldad Livni and Leonid Belkind. In 2019, Symantec purchased Luminate, a zero-trust platform that Smadari had established before joining Torq, Belkind, and Livni-built network cybersecurity products at Check Point.

Before departing to pursue Torq in December 2019, they collaborated at Symantec.

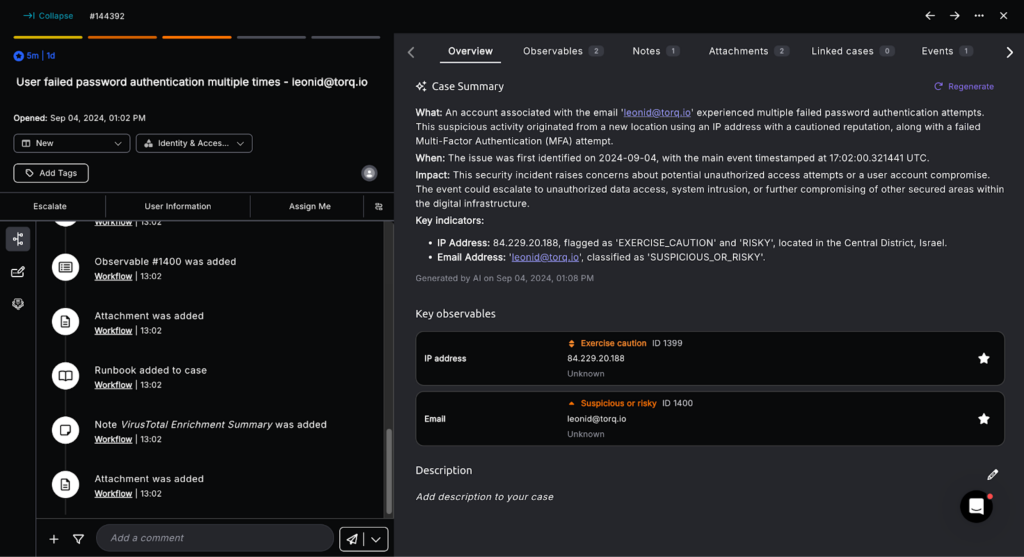

Thanks to the platform, IT teams can now design automated security workflows that work with the infrastructure already in place at their firm. Torq provides a service that uses artificial intelligence (AI) to respond to inquiries concerning SOC playbooks, which are incident manuals used by cybersecurity analysts. Specifically, the service uses big language models similar to OpenAI’s ChatGPT.

Smadari states, “Torq enables enterprises to remediate security events and orchestrate security processes at scale by connecting to the security infrastructure stack.” “With AI-driven capabilities, we hope to supplement human security analysts, freeing them up to concentrate on more complex investigations, while AI handles more routine tasks like triage, investigation, and response.”

It would be ideal if Torq’s AI didn’t frequently have hallucinations or create biases that would harm a security decision. Making the wrong choice when it comes to security might have disastrous consequences.

When asked about the current security issues with AI, Smadari acknowledged certain flaws in Torq’s automation. However, he stated that the business attempts to resolve the problems as they arise.

“We are working with several companies in the field, creating models of risk and attack surfaces, and putting our applications through various testing methodologies,” Smadari continued.

Product R&D and client acquisition will receive the lion’s share of the additional funding from Torq’s Series C, according to Smadari. The almost 200-person Portland-based Torq will strengthen its go-to-market teams over the following months, concentrating on the US, Europe, and Asia.

Smadari states, “The cybersecurity industry has shown itself to be one of the most resilient during conditions of economic uncertainty during the past few years.” “Since the beginning, the expansion of our business has been closely correlated with the growth of our revenue and clientele, as well as the growth of our expenses.”

Bessemer Venture Partners, Notable Capital, Greenfield Partners, and Strait Capital participated in Torq’s Series C.