As IOST prepares a layer-2 transition with 21 billion new tokens and a tokenomics revamp, Upbit has issued a warning to investors.

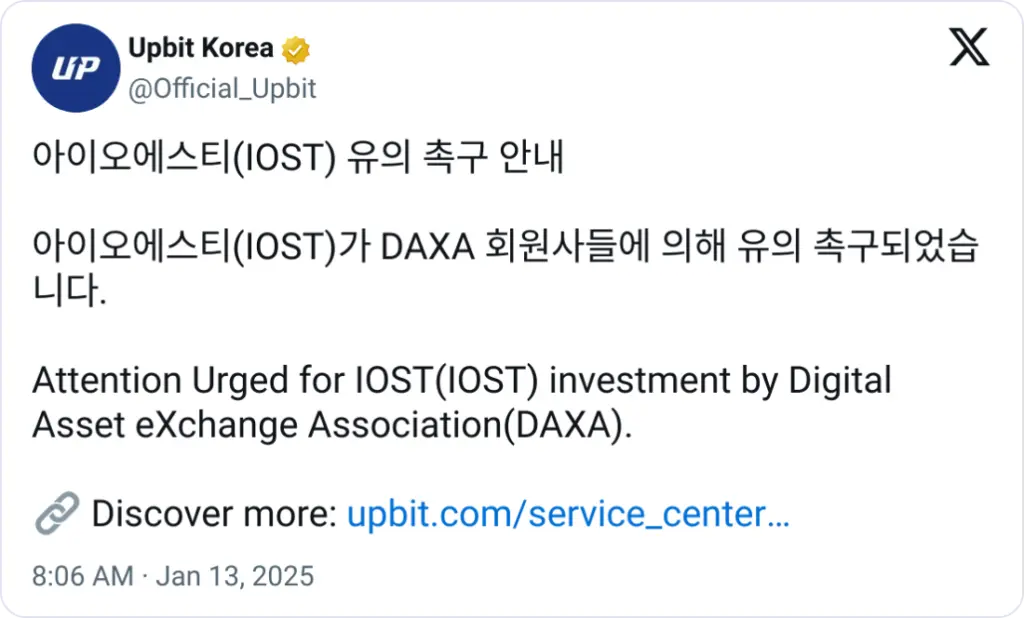

Upbit, a cryptocurrency exchange based in South Korea, has warned that the Digital Asset eXchange Alliance (DAXA) has highlighted the Internet of Services Token IOST$0.006415 for caution to safeguard investors.

Decentralized apps (DApps) are the focus of the blockchain project IOST, which is built for scalability and high throughput.

The project will switch to a layer-2 blockchain in the upcoming weeks, fundamentally altering its network architecture and tokenomics. Twenty-one billion additional IOST tokens will be produced during the changeover, a procedure frequently linked to transient price fluctuation.

Based on DAXA’s recommendations, Upbit has issued a warning on IOST to alert users of noteworthy network or tokenomic developments that may impact the stability of an asset.

Investors were warned

On January 13, Upbit sent a note warning investors who own or trade IOST to proceed cautiously. The announcement came after the IOST development team provided updates on the project’s impending switch to a layer-2 blockchain.

Upbit’s notification states that the action may significantly modify the token’s structure and affect investor sentiment and market value.

Throughout the process, Upbit promised to regularly contact the IOST team to safeguard assets and notify users of any new developments.

DAXA notification and its effects on the market

DAXA aims to provide uniform standards for the leading Korean exchanges. As part of its responsibility to protect investors, it routinely highlights digital assets experiencing structural changes or displaying anomalous market activity.

DAXA has drawn attention to the upcoming L2 transition because of its potential effects on traders, even if IOST’s transition is neither a delisting nor trading suspension statement.

The transfer to L2

The IOST team intends to release over 21.3 billion new tokens to support validator awards, user incentives, and future ecosystem development following the passage of its second governance vote on the transition on January 12.

The team hopes to handle more transactions, increase efficiency, and reduce fees by connecting its new L2 network to its current layer-1 network. A staged supply expansion will see the steady issuance of additional tokens.

Sixty percent of the new tokens will be used for validator rewards, twenty percent for airdrops, eight percent for community incentives, five percent for developer grants, four percent for governance through Nexus DAO, and three percent for team expenditures and salary.