US political shift may unlock the $20T crypto industry if regulatory uncertainty is resolved and the financial advisory industry increases its crypto investment.

The investment director of Bitwise, a crypto asset manager, has stated that the crypto space could be exposed to trillions in the financial advisory industry once United States regulators resolve legal uncertainties.

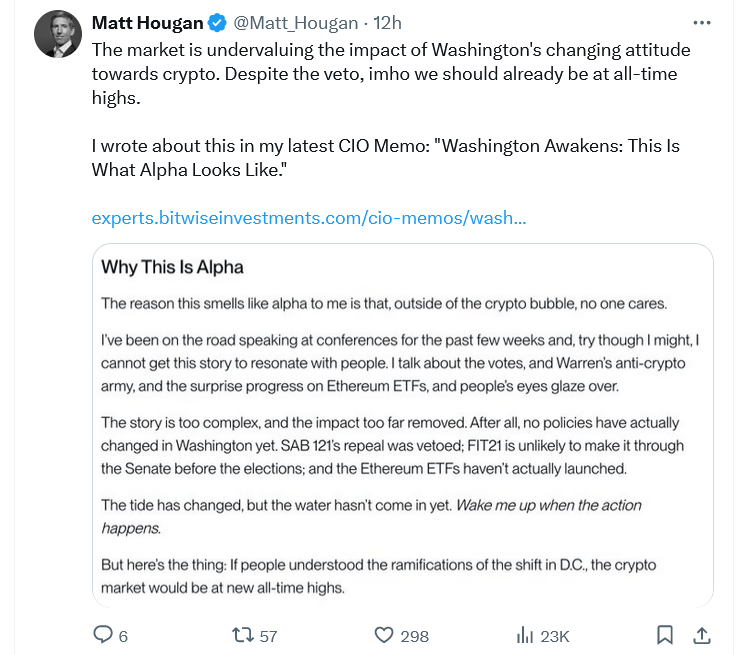

Bitwise chief investment officer Matt Hougan wrote in a June 4 post that regulatory uncertainty is the primary reason financial advisors have not increased their exposure to crypto over the past five years.

Hougan believes the United States is finally progressing toward regulatory clarity, which could facilitate the entry of the country’s $20 trillion financial advisory industry.

“Imagine, then, how much of that $20 trillion will go into crypto when the biggest barrier gets lifted.”

“If you believe that BlackRock’s entry into the crypto space had a positive effect on the market, consider the potential consequences if all of Wall Street were to accept crypto as a standard component of the market,” he concluded.

Hougan stated that a “shift” occurred last month when Democrats “crossed the aisle” to repeal Staff Accounting Bulletin 121 and again when the Financial Innovation and Technology for the 21st Century Act (FIT21) was enacted by the House. Many in the crypto industry regarded this latter act as a victory.

On May 23, the Securities and Exchange Commission also approved spot Ether exchange-traded funds (ETFs) following months of analyst speculation that they would be rejected.

President Joe Biden’s veto of the SAB 121 repeal, which Hougan claimed demonstrated, “crypto still has a long way to go.”

“However, this is a relatively minor setback.” “We have been sailing upwind in crypto for a decade,” he continued.

The market is not ready for what’s next

Hougan thinks that the crypto market is unexplored mainly by those “outside of the crypto bubble,” he believes that a significant amount of “alpha” must be captured.

He continues to observe that “people’s eyes glaze over” when discussing political crypto-related developments at conferences.

“The crypto market would reach new all-time highs if individuals comprehended the implications of the change in [Washington D.C.],” Hougan contended.

Hougan acknowledged that “no policies have changed in Washington yet,” as SAB 121’s repeal was vetoed, FIT21 is unlikely to pass the Senate before the November elections, and the approved spot Ether ETFs have yet to launch.

“The tide has changed, but the water hasn’t come in yet. Wake me up when the action happens.”