Following the election, Bitcoin’s price surge has reportedly brought big banks $1.4 billion in profits from futures contracts.

Forbes predicts that Wall Street banks are sitting on $1.4 billion in post-election gains as a result of the spike in Bitcoin prices.

In the weeks leading up to the presidential election, large banks reportedly poured into Bitcoin futures contracts, accumulating 10,564 new contracts totaling 52,820 BTC.

The Commodity Futures Exchange Commission (CFTC) data, which was made public on November 5, served as the basis for the analysis.

Financial derivatives instruments known as Bitcoin futures contracts let traders make predictions about the future value of the cryptocurrency without actually holding any of it.

Although the majority of US institutions are prohibited from directly holding Btc, they might be exposed to its price swings by using exchange-traded funds (ETFs) and derivatives.

At the Chicago Mercantile Exchange (CME), banks’ brokerage arms held $3 billion in long holdings, with an average purchase price of $65,800.

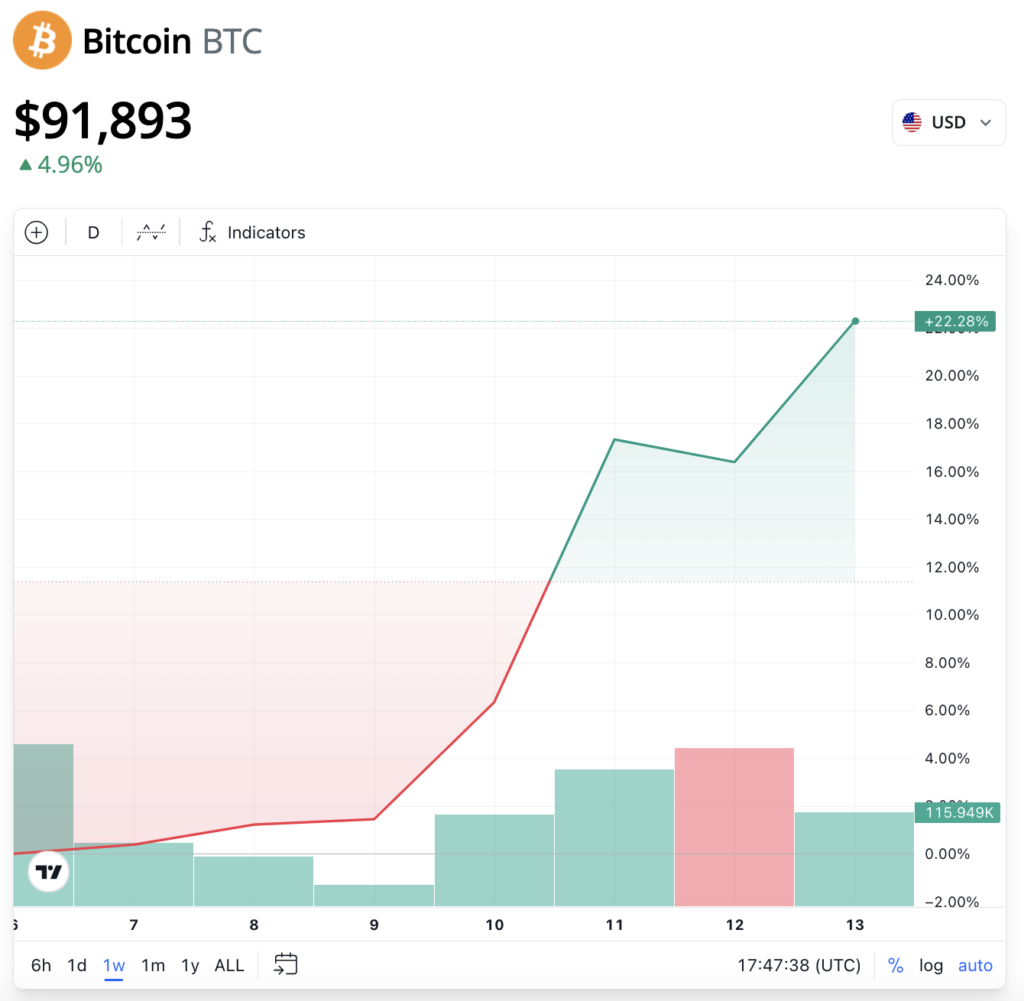

According to Forbes, the 22% increase in Btc since November 6 has resulted in paper gains of almost $1.4 billion.

Between October 8 and 15, the open interest of banks in Bitcoin futures contracts increased by $3.5 billion, from 1,200 contracts (value of $373 million) to 11,766 contracts (worth $3,8 million).

According to current Bitcoin prices, the holding stake is valued at over $5.3 billion, which would provide banks with gains of almost 36% in less than a month.

SG Americas Securities, JPMorgan, and Goldman Sachs are a few financial firms that are active in the cryptocurrency derivatives markets.

Donald Trump’s reelection on November 6 is partly responsible for the recent spike in Bitcoin prices, as cryptocurrency markets expect federal agencies to work more cooperatively under the new administration.

The previous few days have also seen a sharp increase in the shares of publicly traded cryptocurrency companies. Coinbase’s shares (COIN) surged over 20% on November 11th, hitting $300 for the first time since 2021.

On November 13, the market capitalization of cryptocurrencies was $3.17 trillion, increasing 119% from the previous November, according to CoinGecko data.